The ice melts between us, or the spring prospects for the USD.

Good afternoon, dear and insatiable hunters for the latest news and forecasts on the international currency market ForEx. With you, the best pirate and ranger of Exchange Take Profit by the end of 2017 – Andrew “Golden Eye” Green.

I would like to start this article today with such a small talk …

Do you really believe that at this time interval in the development of the world economy, the United States demonstrates and actually develops weaker than the European united economy and a number of other countries generators of world GDP ..?

Do you really believe that the rise in oil prices for the country, which is the third in the world in terms of the production of black gold, can shake or weaken the national currency relative to the currencies of other countries ..?

Do you really believe that the record dynamics of the US stock market and its possible pullback can cause a weakening of the most popular reserve instrument in the world ..?

Dear ones, turn your head and do not give in to idle reflections. The US economy, like the USD, is still very far from the moment of global macroeconomic turn. And this will not happen at least until the US Federal Reserve rate reaches a level of at least 3.5% and, of course, the target inflation level on average of 2-2.5%.

Be very careful in trading against the dollar. Of course there was a very strong overbought after 2014-2016. But to expect a return to the levels of 2013 and the first half of 2014 is not worth it yet. The US is just entering the zone of highs of its next economic take-off and, on the other hand, there is simply not enough economic drive from other donor countries for world GDP for this. Those who could make money on correction, great for you! But do not be in a hurry. Winter is coming to an end, and the prospects for a fourfold increase in the US discount rate are becoming clearer and clearer. And do not forget that this year in the FOMC for one “owl” will be less (William C. Dudley), and to the “hawk” flock will come more.

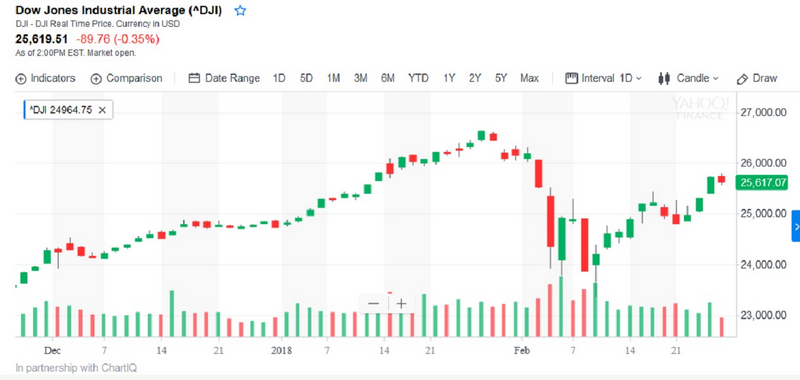

Well, I think that for one article of fundamental analysis is enough, let’s take a look at the dynamics of the main indicators of the US financial market. Let’s start with the DJIA stock index (Figure 1).

As we see, after a short-term market check for panic fluctuations, the chart is leveled, confidently approaching the next re-test of the highs at the index – 27000,00. It should be noted that all this happens without a standard inverse correlation of the stock market and the national currency. For those readers who first encounter the notions of correlation and intermarket analysis, I recommend to have a look at the appropriate training course from the Ester Holdings partner company, in more detail you can get acquainted with the structure of the course on the site, there you can also fill out an application for training.

The next indicator is another puzzle in the overall picture of the nearest prospects for USD, this, of course, is the index of investor sentiment from CBOE-VIX (Figure 2).

As we see, after a sharp surge, the situation stabilizes and the index falls to a calm zone below 20 units, and with a decrease to 10, we expect further growth of investors’ interest in risky assets, and now the formation of stable sentiments in the safe haven and government bonds market. Which, to a greater extent, strengthens the position of the USD in relation to other regional currencies.

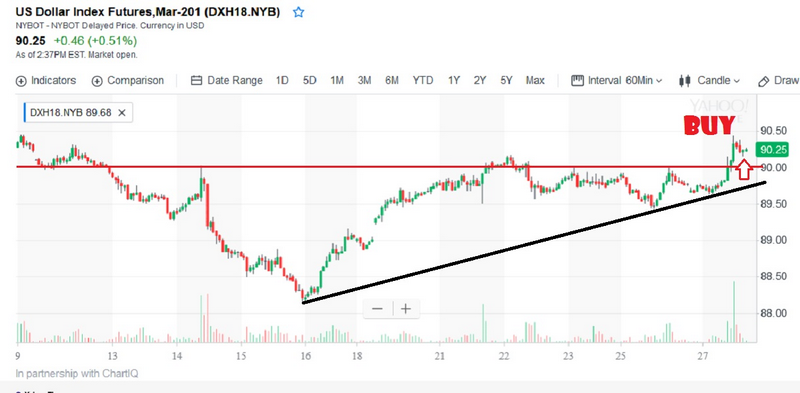

And let’s have a closer look at the data on the dollar index DXH (Figure 3).

The chart clearly tracks the breakdown of the psychological level of 90.00 with further prospects and targets around 92.00 and resistance at 92.40-60.

My main expectations and recommendations are BUY.

Examples of trade transactions:

- conservative option:

BUY limit 90.00, SL 89.00, TP 92.00, - aggressive option:

BUY (from the current) 90.25, SL 89.00, TP 92.00.

“Do not wander in the wilds of other people’s opinions, learn to shape your own.” Know how to hear others,

but remember that many speak out, and earn a few.

Keep your nose in the wind of financial success. “

Andrew Green