Technical analysis of cross-rates. (Anton Hanzenko)

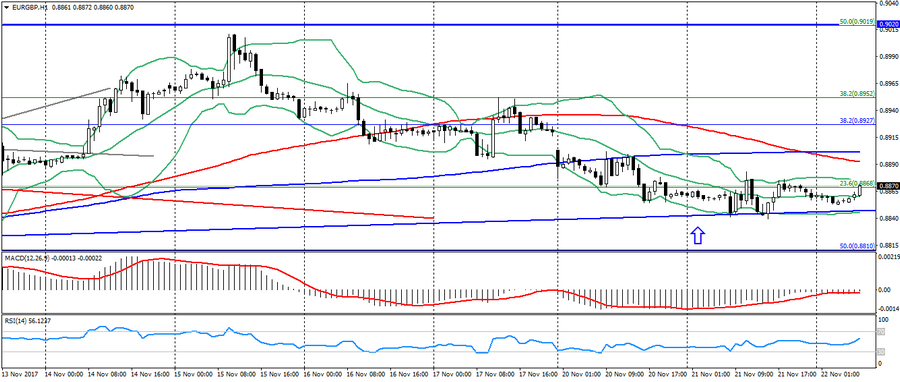

EUR GBP (current price: 0.8870)

- Support levels: 0.8730 (minimum of the last months), 0.8650, 0.8530.

- Resistance levels: 0.9020, 0.9170, 0.9300 (the maximum of the current year).

- Computer analysis: MACD (signal – downward motion): the indicator is below 0, the signal line is in the body of the histogram. RSI is in the neutral zone. Bollinger Bands (period 20): neutral, declining volatility.

- The main recommendation: sale entry is started from 0.8890 (MA 100), 0.8930 (Fibo. 38.2 from the April low), 0.8950.

- Alternative recommendation: buy entry is started from 0.8850, 0.8830, 0.8810 (Fibo. 50.00 from the April low).

The downward dynamics of the cross-rate remains in force, but is limited to significant support 0.8840-10, from which a correction is observed.

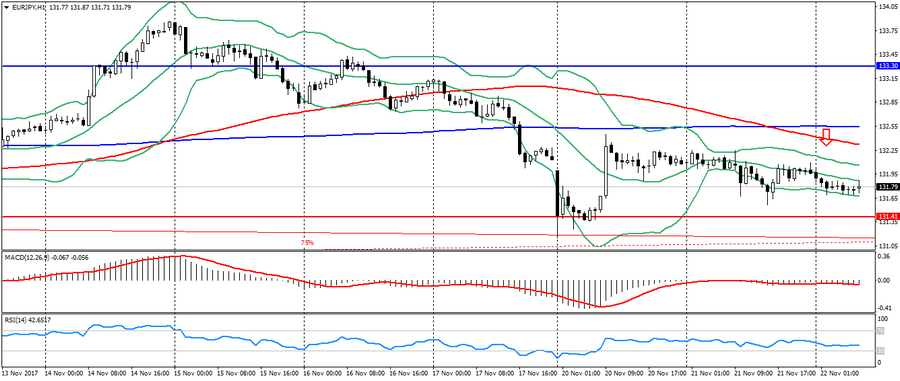

EUR JPY (current price: 131.70)

- Support levels: 131.40 (minimum of the last months), 130.50, 129.80 (Fib. 23.6 from the low of the current year).

- Resistance levels: 133.30, 134.40 (the maximum of the current year), 135.00.

- Computer analysis: MACD (signal – downward motion): the indicator is below 0, the signal line is in the body of the histogram. RSI is in the neutral zone. Bollinger Bands (period 20): neutral, low volatility.

- The main recommendation: sale entry is started from 132.00, 132.30 (MA 100), 132.50 (MA 200).

- Alternative recommendation: buy entry is started from 131.40, 131.00 (November minimum), 130.60.

The euro-yen remains under pressure, despite the ambiguity in the euro area and the preservation of flat on the cross.

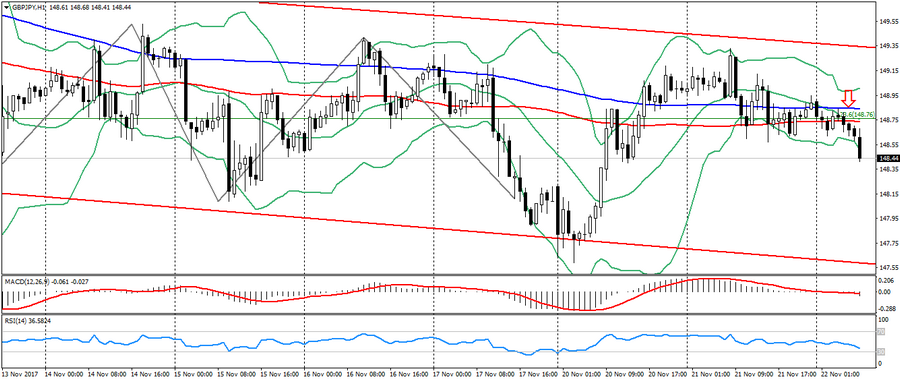

GBP JPY (current price: 148.50)

- Support levels: 147.00 (minimum of last months), 144.20 (Fibo, 50.0 from the low of April), 141.50.

- Resistance levels: 151.30, 152.80 (the maximum of the current year), 155.40.

- Computer analysis: MACD (signal – downward motion): the indicator is below 0, the signal line is in the body of the histogram. RSI is in the neutral zone. Bollinger Bands (period 20): oversold, growing volatility.

- The main recommendation: sale entry is started from 148.70 (MA 200), 149.00, 149.30.

- Alternative recommendation: buy entry is started from 148.30, 148.00, 147.70.

The pound-yen resumed the downward trend, keeping the movement in a downward trend within the common downward channel.

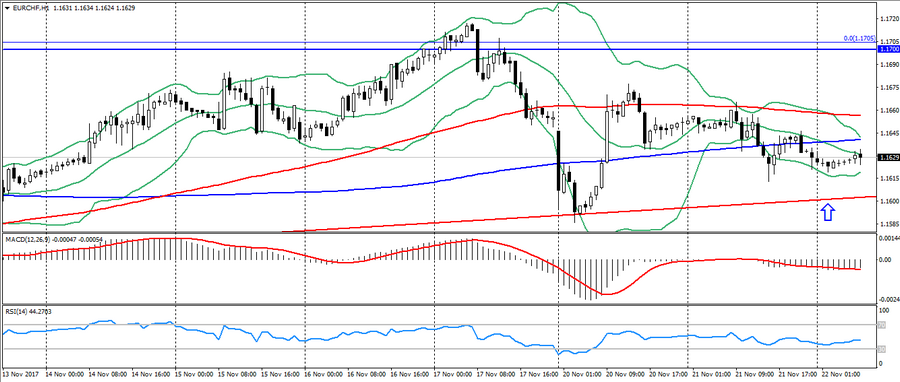

EUR CHF (current price: 1.1630)

- Support levels: 1.1500, 1.1450 (Fibo, 23.6 from the low of the current year), 1.1350.

- Resistance levels: 1.1700 (the maximum of the current year), 1.1750, 1.1800.

- Computer analysis: MACD (signal – upward motion): the indicator is below 0, the signal line has left the body of the histogram. RSI is in the neutral zone. Bollinger Bands (period 20): neutral, low volatility.

- The main recommendation: sale entry is started from 1.1660 (MA 100), 1.1700, 1.1730.

- Alternative recommendation: buy entry is started from 1.1600, 1.1570, 1.1550.

The euro-franc pair declines, while maintaining an upward trend.