A pig in a poke, or what is special about these protocols of the ECB (11/01/2018)?

Good afternoon, amateurs and professionals of exchange trade.

With you Andrew Green, and we again return to the pair EUR/USD.

Let’s start with the most important thing – trading recommendation:

SELL – SELL – VERKAUFEN – VENDRE – VENDERE.

Well, I hope you understood).

Now, let’s come across the facts. Let’s start, perhaps, with a fundamental, not very deep, but nevertheless analysis. Yesterday afternoon, at 12:30 UTC, the another ECB minutes were published.

Most often, the output of such news from the European Central Bank passes without visible movement in the market. What was special about them this time, if 30 seconds after their official release, there was a movement of almost 60 basis points (1.1940-1.2000).

The protocols themselves are the release of information on how discussions took place at the last meeting of the Governing Council of the ECB, which took place on December 14, 2017. The market reaction to this news is low, due to the fact that most often, before their publication, most of the information has already been published, or voiced at press conferences, right after the meeting.

Well, we have the opportunity to closely study these memoirs, and there we see … NOTHING NEW … The protocols repeat exactly the same thing that was voiced after the meeting in December 2017. In fact, it’s just the first in This year, REPETITION of what was then decided.

For two days, the fundamentals has twice tried to correct the attempt of the euro to form a reversal, but so far with a subsequent pullback.

Yesterday there was a “duck” from Bloomberg about the alleged decision of some Chinese officials to suspend purchases of the US government bonds, which later China officials themselves denied.

Today is an unjustifiably active reaction to a news group with a low coefficient of influence.

In general, there are attempts to indirect influence on the market, but as people say: “not caught – not a thief …”

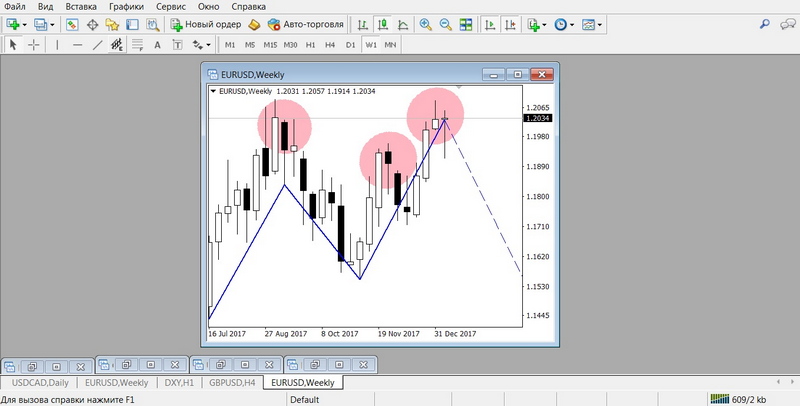

And now let’s have a closer look at our charts. And here I suggest a little long-term analysis of the older timeframes. Figure 1 (weekly timeframe).

It is an interesting picture using Fibonacci channels with internal levels. If you want to learn more about graphical tools for technical analysis, refer to the individual training courses on stock exchange trading.

As you can see, the market price has shifted to the last three quarters of the channel. And, being in this range, the probability of a turn and a return to the main trend prevails over the turn potential, especially in the areas of the channel lines, in our case this is the MONTH ¾ line. In the future, the breakdown of the upward support line of the daily trend DAY will form a very strong signal for reversal and the formation of the technical analysis figure “double top”.

On this, we do not finish our long-term analysis, but instead turn to the most interesting. We pass to Figure 2, where we will be engaged in a candlestick analysis of the same weekly timeframe, and here we have a very interesting situation.

I highlighted with pink a few recent reversals, which were previously accompanied by clear candles of “doubt”, and after last week we have the same candle. After the volatility of the last two days, there is every chance to get another argument in favor of reversal. If you have any questions about candle arguments, then write letters to Ester’s support email (support@esterholdings.com), with a note for Andrew Green.

And now directly enter the transactions, Figure 3.

Here everything is as usual – clear and simple)

Examples of transactions:

- conservative option:

SELL limit 1.2080, SL 1.2150, TP 1.2010 - aggressive option (with averaging):

SELL (current) 1.2040, SL 1.2150, TP 1.1940

SELL limit 1.2080, SL 1.2150, TP 1.2010

Recently, I increasingly notice attempts to indirectly influence the market, if you also notice such “symptoms”, then write about such cases to the Ester’s support email (support@esterholdings.com), marked for Andrew Green and additional a note “A PIG IN A POKE”.

Have a good trade and the passing financial wind “Gentlemen” of the fundamental and technical analysis.

Your helmsman of the International Currency Market,

Andrew Green.