Emerging markets and their prospects: Chinese yuan (CNH or CNY)

The economy of the People’s Republic of China (PRC) is one of the most developed, only the US are behind in nominal GDP. At the same time, China is the absolute leader in GDP by purchasing power parity (PPP). The economy of the PRC shows an increase from year to year. Today the Chinese yuan is in focus.

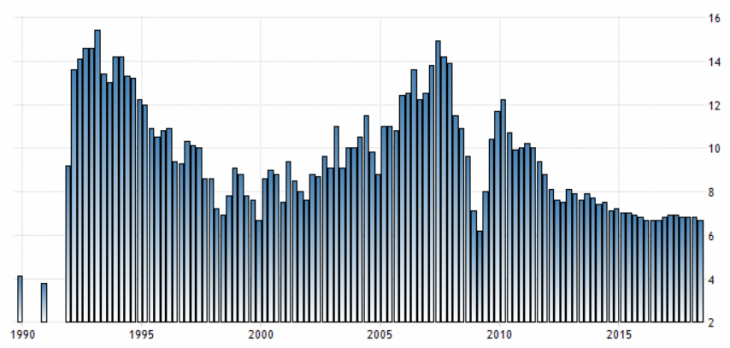

China’s GDP growth chart

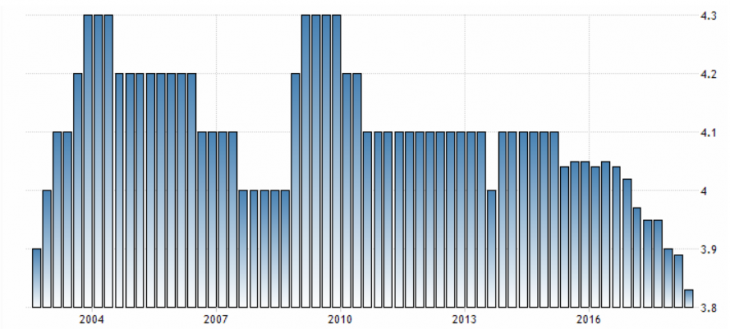

The People’s Republic of China is considered the world’s industrial producer, since most of the world’s goods are produced in China. China is the world leader in exports, which makes China a significant participant in the international market. As a result, China has a very low unemployment level .

China’s Unemployment chart

Features of Chinese yuan trade

The Chinese yuan is a very specific currency, due to the fact that the PRC is a communist country, and the People’s Bank of China is fully regulated by the PRC government. As a result, the Chinese yuan is tightly controlled by the People’s Bank of China, which does not allow it to move beyond the People’s Bank of China established range.

Also, due to these restrictions from the People’s Bank of China, there are concepts of “offshore yuan” (CNH) and “onshore yuan” (CNY). In fact, this is the same currency, but the offshore yuan (CNH) is traded on the FOREX market, when the onshore yuan (CNY) is traded only in China and can be controlled by the People’s Bank of China. At the same time, both currencies have unidirectional dynamics because of their nature. Therefore, intervention against the onshore yuan (CNY) also affects the offshore yuan (CNH).

Since the People’s Bank of China does not benefit from a strong national currency for economic growth, the Chinese yuan remains under pressure beyond a soft monetary policy, which is responsible for the general upward trend of the USD/CNH pair.

Due to the fact that China is the world leader in exports, the trade conflict between the US and China has also tough on the Chinese yuan, which makes the yuan very vulnerable to such conflicts and data on the deterioration in trade or political relations.

Correlation of the Chinese Yuan with other currencies

Correlation table USD/CNH

The USD/CNH pair is very promising for long-term investments, taking into account the volatility of the currencies of the emerging market and the preservation of long-term trends. This allows you to implement trend strategies and trading on the news successfully.

Anton Hansenko