Canadian perspectives. How to trade on USD/CAD this week!

Good afternoon, dear ones, we are of the same blood. Gold currents of transactions, news, points and pips flow in our veins, all that the world of exchange trade is full of. Let’s start our trading week, and with you Andrew Green your guide to the financial market.

The Canadian dollar operates in its repertoire, remaining an individual in the instruments team in the currency market. Unlike most, which showed a dynamics of 400 points and above, the Canadian for the whole week passed less than 200.

The foundation of this week for the Canadian does not contain special accents, to a greater extent, the main expectation is the dynamics of the US dollar and oil.

From the geopolitical side we are waiting for the continuation of negotiations on NAFTA. From the latter – the head of the Canadian delegation said that the sentiment is constructive and there are chances for the reconciliation of certain items and new conditions. In general, the situation is abstract.

My expectations for the pair – a correction, mainly focused on the basic dynamics of the dollar, pending the meeting of the Committee on open market operations (Wednesday, January 31, 2013, at 19:00 UTC) and publication of employment reports in the US (Friday, 02/02/2018 , at 13:30 UTC).

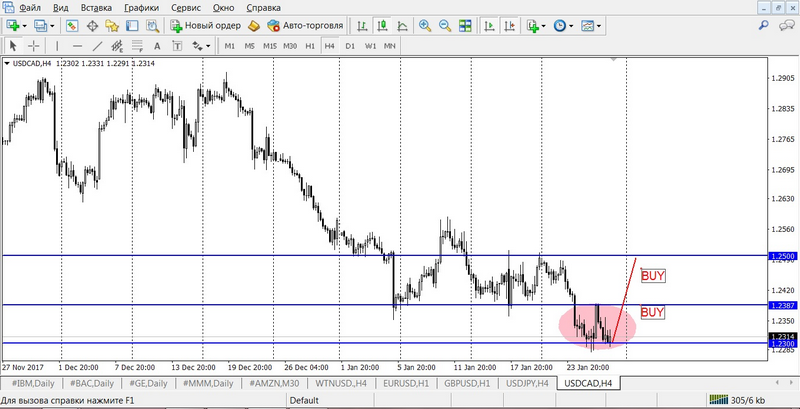

Let’s take a look at the charts. Figure # 1 – timeframe H4. The pair came close to the psychological level of 1.2300. In fact, the second touch of this level, which can form a double bottom with the development potential of the figure to 1.2500. In turn, the breakdown will open the movement to strengthen the Canadian dollar to the level of 1.2200.

My main recommendation – BUY on the rebound from 1.2300 and the formation of the figure “double bottom” with a further extension to the level of 1.2500.

Examples of transactions:

- conservative option:

BUY stop 1.2410, SL 1.2350, TP 1.2490 - aggressive option:

BUY (from the current 1.2310), SL 1.2260, TP 1.2380

BUY stop 1.2410, SL 1.2350, TP 1.2490

Dear friends, keep your nose in the wind and watch out for figures. Those who do not have much experience in trading in figures, or those who are not familiar with them at all, you have a unique opportunity to pass an individual training course from the best specialists and traders from the Ester Holdings Inc. team. More information can be found on the company’s website. Sign up and I’ll help you to master the practice with the least risk for your capital. Write to support@esterholdings.com with a note for Andrew Green.

Practical knowledge and experience in the financial market are grains of gold in piles of sand, appreciate them and use them to the maximum!

Andrew Green