How has the economy of Great Britain changed after the announcement of Brexit and how it affected the pound.

June 23, 2016 in the UK was a referendum, which decided the future of the country within the European Union. According to the voting results, 51.9% of the voted in favor of withdrawing from the EU. This decision of the British caused a great surprise to the world community, since before the vote itself a large number of polls and opinions of political scientists talked about the opposite. How did the economy of Great Britain change after the announcement of Brexit?

What was the impact of the results of voting on the British pound

The voting results had a very negative impact on the British pound. Already in the first 24 hours after the vote, on June 24, 2016, the British pound dropped against the US dollar by almost 1800 points, reaching the level of 1.3119. In October 2016, the pound reached a minimum against the US dollar over the past 12 years, reaching a mark of 1,1604.

Fig.1 Decrease in the GBP/USD pair from June to October 2016

Most of the pressure on the pound was provided by investors’ concerns about the further development of the UK economy in the context of Brexit. The withdrawal of the UK from the EU mainly threatened the loss of markets and trade agreements that the Kingdom had as part of the European Union. Also, one of the major problems is the work of European companies in the UK, which can become more complicated after leaving the EU, which can negatively affect the unemployment rate in the country.

The UK economy – how Brexit affected the economic performance of the country:

To see how all the same decision of the British to withdraw from the EU impact on the economy of the UK one needs to look more closely at how during this time the key economic indicators of the country have changed.

1. GDP – In Q4 2016, the growth was the highest for the whole year and was 0.7%, while in the 1st quarter of 2016 this indicator was at 0.2%. The GDP growth rate slowed in early 2017, but in the fourth quarter it reached 0.5%, which is the average for the last 3 years.

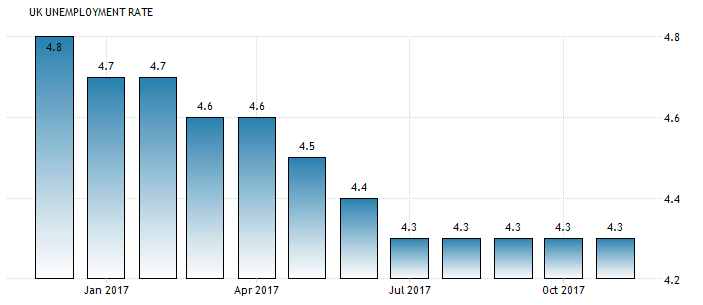

2. Unemployment rate. According to data for June 2016, the unemployment rate in the UK was 4.9% and already in 2017, the indicator moved to a decrease and in December it was 4.3%.

3. Inflation – Since the decision of the UK to leave the EU, the inflation rate in the country has grown significantly. As of June 2016, inflation in the UK was 0.6%, and in the last quarter of 2017 it stabilized at 3.0%, which in the world economy is the upper limit of the target range, which contributes to economic growth.

4. The interest rate. Since 2016 and today the interest rate of the Bank of England has been changed twice. In August 2016, the discount rate was reduced from 0.50% to 0.25%. The QE program was expanded from 375D to 425D, all aimed at additional monetary stimulation of the economy for its protection in the Brexit conditions. In November 2017, the Bank of England raised the interest rate, returning it to 0.50%, which it was decided to do to keep inflation in the country.

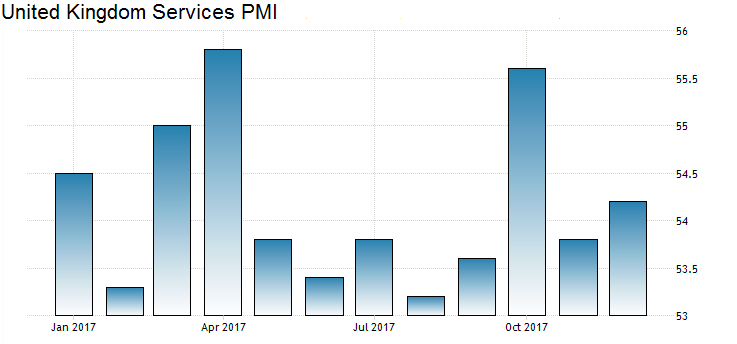

5. Business activity. It is also worth noting that the indices of business activity, both in the manufacturing sector and in the services sector of the UK, are above the level of 50.0, which indicates the positive state of key sectors of the country’s economy.

British pound in 2018

Looking at the above described main indicators of the country’s economy, it is worth noting that, despite the pessimistic forecasts for the development of the UK economy after the decision to leave the EU, the economy of the Kingdom at least maintained its previous performance, and the decrease in the pound in 2016 helped “reset” the economic processes in the country .

As a result of continued economic growth and optimistic sentiment on the issue of Soft Brexit, the British pound managed to recover 80% of lost positions against the US dollar after the UK decided to leave the EU. At the beginning of 2018, the growth of the GBP/USD pair was supported by a general decline in the US dollar across the whole spectrum of the market, but such growth would not have been possible in the case of weak economic data for the UK.

Fig. 7 Growth of the GBP/USD pair from October 2016 to January 2018

Conclusion

It is worth noting that the UK economy is so strong that it will even be able to survive the temporary loss of part of the markets, which is due to the re-signing of new trade agreements already outside the European Union. But this process is still far away, as the transition period will be completed in March 2019. If trade relations with EU countries persist during the transition period, the British pound will maintain an upward trend in the long term and by the summer can regain all lost positions as a result of Brexit.

Alexander Sivtsov