Great Britain – an eternal dilemma: smart or beautiful)

Good day, dear fans of the high income market and exchange trade. With you again, a golf lover, but at the same time professional in trading Andrew Green.

As you could understand from the title and my “fine” British humor, today we will discuss the situation that has developed at the moment with the British Pound. And to be more precise, with the pair GBP/USD. Let’s start with the most important:

Trade recommendation: SELL (with accumulation)

Now, of course, the rationale:

Despite the fact that more than a year and a half has passed since the “THAT” referendum (July 23, 2016 – Referendum on the membership of Great Britain in the European Union), which ended with the unpleasant decision for many on the withdrawal, as well as a very large number of conversations about Hard and Soft exits from the above-named union, the situation on Foggy Albion remains “foggy”.

In fact, the strong British economy, high “temperature” in the real estate market and excellent performance in the employment sector do not give the Bank of England the opportunity to pursue a soft policy. A soft policy now is actually very necessary. If Britain enters the era of “independent” business, then it should focus on exports, which, in turn, requires a more dynamic approach to the monetary policy.

As a result, for a long time we have seen the formation of a stable, but very sluggish trend for growth (WEEK support line). If we have a closer look at Figure 1, where you have the opportunity to observe the timeframe D1, one can see consolidation in the form of a triangle with a gradually decreasing, until December 2017, resistance line DAY-H4.

And it looks like there is a breakdown of this triangle, but now I see such a familiar situation. Pay attention to the pink zones. The first one, which is lower, formed the last minimum in the triangle and gave an impulse for the subsequent impulse to the top and breakdown of the downward resistance line. But taking into account that it did not finish the logical support line for the triangle, the impulse was weak, and as a result after the breakdown, the pair, having overcome the level of 1.3500. The pair could not tear it away from it and again consolidate, only at the double top, giving a sufficiently clear signal to the possible breakdown of 1.3500 and return to lower ranges. The situation is not simple, but I have already seen such, and you, I hink, as well.

My version of the further development of events is quite simple. In connection with the need for a more flexible policy, the Bank of England will try to prevent further high appreciation of the Pound. The key ranges are 1.35-1.4000.

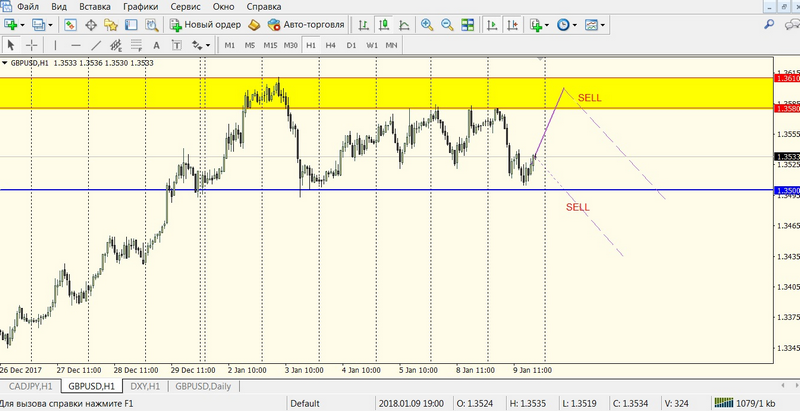

But since I see the need to earn now, and not later, as I advise you – one should consider such situation for trade in this way … Let’s look at Figure 2 (Timeframe H1).

This time I propose two options for conservative trading:

- conservative option number 1:

Sell limit 1.3590, SL 1.3630, TP 1.3530 - conservative option number 2:

Sell stop 1.3485, SL 1.3530, TP 1.3420

My “main” aggressive option with accumulation:

- Sell (from current) 1.3540, SL 1.3630, TP 1.3420 (development of double top)

- Sell limit 1.3590, SL 1.3630, TP 1.3530 (trading in flat)

- Sell stop 1.3485, SL 1.3530, TP 1.3350 (trading in the triangle)

Which of you, dear friends, are interested in the options of the aggressive trade that I use, as well as the basic principles of technical analysis, namely, the figures of technical analysis, which I often recalled in this article, please contact me for advice. Please, use the address of support of the Ester Holdings support@esterholdings.com, with a topic “for Andrew Green”. Also you can learn more and get trained all the necessary skills during our training courses, which are selected for traders with different levels of experience as well as for all beginners.

Let’s continue trading, gentlemen … Everything is just begins)