The pound is under pressure. Data on housing prices in the UK

The British pound declined against the US dollar at the beginning of the European session. This movement is caused by the caution of investors in anticipation of tomorrow’s meeting of the Bank of England. Also, some pressure on the British currency is provided by data on housing prices in the UK from Halifax, according to which prices fell in January by -0.6%, against analysts’ forecast at the level of 0.1%. On an annualized basis, the growth rate slowed to 2.2%, against the previous value of 2.7%.

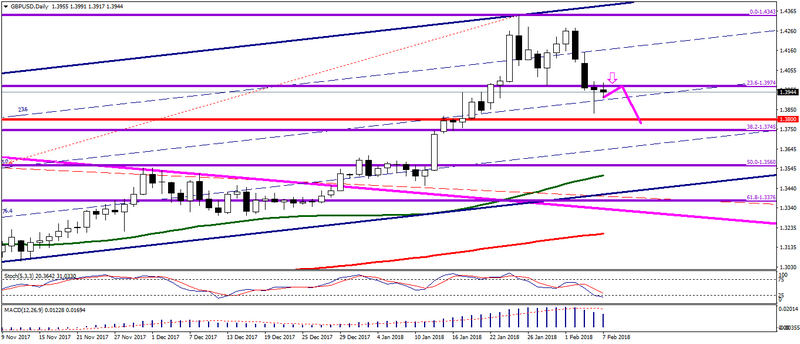

Technical analysis: On the D1 chart, the pair GBP/USD was fixed below the level of 23.6 Fibonacci lines, which is confirmed by my yesterday’s forecast about continuation of the downward correction of the pair to the levels of 1.3800 1.3745. See “Opinion on the pair GBP/USD. The decline in the pound may continue. “

Key recommendations: The main recommendation is the sale of the GBP/USD pair in the area of 23.6 Fibonacci level at D1, but it should be borne in mind that the market participants are already waiting for tomorrow’s meeting of the Bank of England, so I recommend not to set big profit targets and, if possible use the Trailing Stop function.

Fig. GBP/USD. The current price is $ 1.3944.

Alexander Sivtsov