Features of trading on crosses containing the euro (EUR)

Continuing the series of articles devoted to the trade of individual currencies, the euro deserves special attention. In previous articles, attention was paid to the Japanese yen and the British pound .

The euro is one of the liquid currencies that can compete with the US dollar. And on some parameters, the euro looks more attractive for investments than the US dollar. Especially considering the US monetary policy under Trump.

Data on the economy of the euro area

The euro area or the European Union is 26 European countries, whose economies, in addition to central banks, are controlled by the European Central Bank (ECB). Like the policy of most major world banks, the ECB policy focuses on super-soft monetary policy. So from April 2016, the eurozone interest rate is cut off at around 0.00%. Also, the ECB uses a quantitative easing program, which aims to raise inflation to a target level of 2%. Recently, the topic of reducing the amount of stimulation of the eurozone economy remains acute and contributes to the strengthening of the single currency.

A relatively recent referendum in the UK (Brexit) has exacerbated the separatist sentiment within the EU, which has a negative impact on the euro. It also caused a number of problems within the eurozone associated with the expansion of the rights of some countries and regions of the euro area.

The main economic driving force of the eurozone is the German economy. Therefore, the statistics for Germany is perceived for the euro is also significant, as in the euro area, and in some cases even more acute. In this case, the single currency positions itself as a very independent one that does not have a clear link to the raw materials or to the assets of the safe haven. EUR ranks second in importance after the US dollar.

The euro has an inverse correlation with the major stock indices of the eurozone: Stoxx 50 (blue line) and DAX 30 (orange line).

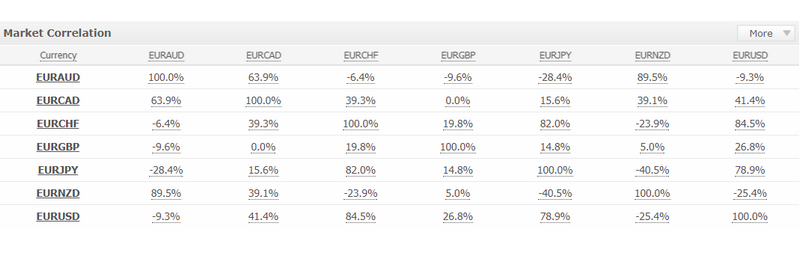

Cross-rates containing the euro have a very high degree of correlation between similar currencies. So the commodity currencies and safe haven currencies are traded unidirectionally against the euro. Thus confirming the similarity of the euro with the US dollar.

As mentioned above, cross-rates containing the euro are more traded unidirectionally, especially against similar currencies. At the same time, the dynamics of the euro itself largely depend on the US dollar. This is because the euro and the US dollar are the most traded currencies in the world and the decline or growth of one currency almost always affects the other.

Because of this relationship, the euro and the American almost always has a high degree of inverse correlation. That allows you to track the periods of rest and the trend in the market and the advantages of one currency over another.

Methods of technical analysis are also applicable to crosses containing the euro, but they are applied in specific cases and on specific currency pairs in certain situations. The main feature of the euro is its overall focus, which allows you to determine its dynamics relative to other currencies, which is used in trend strategies.

As the euro is more similar to the US dollar, then the strategies for trading on them are also similar. More details about them and not only can be learned from the training course.

Hanzenko Anton