EUR/USD today: the pair is preparing for the Fed report

At tradings on Tuesday, the pair did not justify expectations of a sideways trend and accelerated the decline based on the positive statistics on the US, thereby justifying the indicated trading range. Today, the trades opened with a correction of the pair after yesterday’s decline, but remain limited by the lateral trend and the expectation of the report of the US Federal Reserve.

Events for today:

- 15:30 – release of data on inflation in the US: the basic consumer price index (CPI) and the consumer price index (CPI).

- 17:30 – publiction of the data on oil reserves in the US.

- 21:00 – publication of the results of the meeting of the US Federal Reserve: the economic forecasts of the FOMC, the statement of the US Federal Open Market Committee and the decision on the interest rate of the US Federal Reserve.

- 21:30 – a press conference of the US Federal Open Market Committee.

The publication of the US Federal Reserve Protocol is considered as the main event of the day. The expectations regarding the Protocol are already on the website.

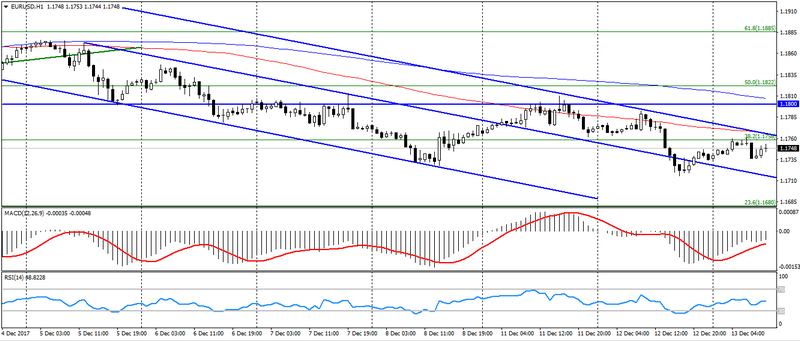

The pair EUR/USD and the market as a whole will expect data from the Fed, which will limit the dynamics of the market. Given the optimistic expectations from the Fed and the safety of the downtrend, it was worth expecting a further decline in the pair EUR/USD to support levels: 1.1710-00, 1.1680-70 and 1.1650-30. But, before the publication of the report, it is pointless to talk about the results and strength of the movement. The resistance levels are : 1.1800-20, 1.1860 and 1.1880-90.

Fig. EUR/USD. The current price is 1.1750.

Hanzenko Anton