U.S. data

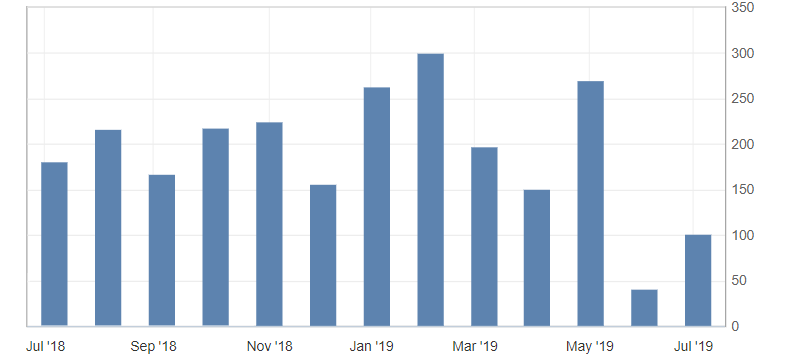

- ADP non-farm employment change (June), fact 102K, forecast 140K.

- Initial jobless claims, fact 221K, forecast 220K.

- Trade balance (May), fact -55,50B, forecast -53,20B.

US data have fallen short of market expectations. Significant concerns were caused by data on the labor market, which not only showed a slowdown in job growth according to ADP, but also showed an increase in applications for benefits. Against the background of the Friday employment report in the United States, this is a very alarming bell.

Fig. 1. ADP non-farm employment change chart

The US dollar index reacted very cautiously to the US data, which confirmed the focus of the market on general sentiment. As a result, the US dollar index continues to trade in the side channel from 96.70-60 to 96.80-90, at the same time forming a flat and maintaining an upward trend.

Fig. 2. The US dollar index chart. The current price is 96.80 (10-year US government bonds yield is the blue line)

Read also: “World reserve currencies and their popularity”

Hanzenko Anton

Earn with the help of the trade service on the news Erste News!

Topical articles of the trader’s blog:

- OPEC + Market expects continuation of agreement to limit production

- G20 Summit – what to expect and to beware of

- Prospects for the USD/JPY for early July

Current Investment ideas: