U.S. data

- Core Producer Price Index (PPI) (m/m) (Apr), fact 0.1%, forecast 0.2%.

- Initial jobles claims , fact 228K, forecast 215K.

- Producer Price Index (PPI) (m/m) (Apr), fact 0.2%, forecast 0.2%.

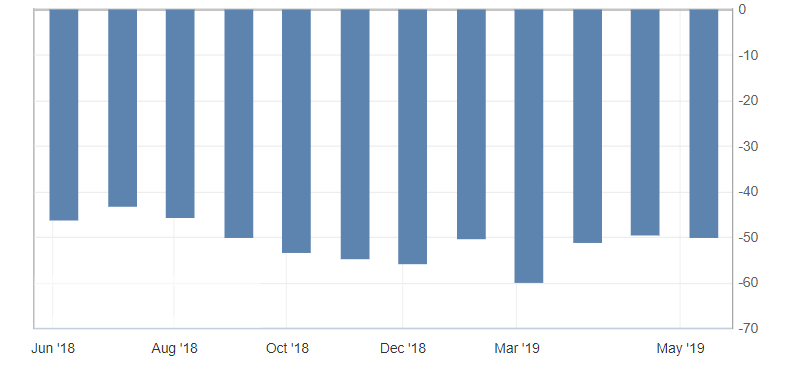

- Trade balance (March), fact -50.00B, forecast -50.20B.

The published block of statistics on the United States turned out to be ambiguous and very diverse. Thus, core producer price index (PPI) (m/m) (April) slowed down to the minimum positive value, thereby confirming the slowdown in the US inflation and the persistence of concerns about the US consumer price index. Primary applications for unemployment benefits showed a marked increase for the third week in a row, which is also a very negative indicator, despite the very strong US labor market. One of the positive news of this report was the data on the US trade balance, which continues to reduce the deficit, despite the weak pace.

Fig. 1. U.S. trade balance chart

In general, this report looks more negative due to continued concerns about inflation. In the context of market restraint, these statistics will increase the pressure on the US currency. Thus, the US dollar index retreated from daily highs, retaining the lateral dynamics of the current week. In addition to the general restraint of the market, investors will expect a speech by the US Federal Reserve Chairman.

Fig. 2. The US dollar index chaty. The current price is 97.60 (10-year government bonds yield is the blue line)

Read also: “Medium-term prospects for the US dollar for August-September”

Hanzenko Anton

Earn with the help of the trade service on the news Erste News!

Topical articles of the trader’s blog:

- Skills each investor must develop

- What is interesting about the US Fed meeting in April and how it can affect the world banks policy?

- Stock Indices: Storming Historic Highs

Current Investment ideas: