U.S. data

- Initial jobless claims, fact 214K, forecast 219K.

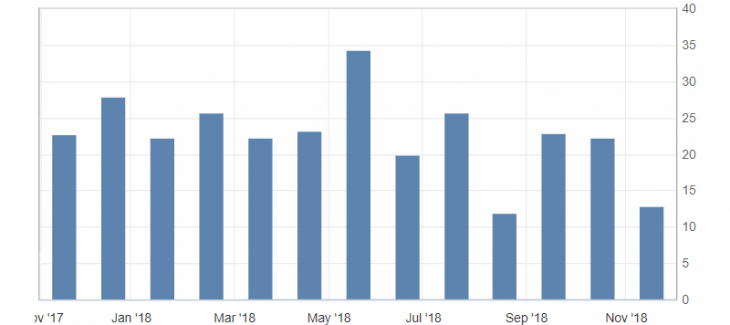

- Philadelphia Fed manufacturing index (December), fact 9.4, forecast of 15.6.

- Philadelphia Fed employment index (December), fact 18.3, previous value 16.3.

The news block for the United States was generally restrained negative, due to very weak statistics on the manufacturing activity index from the Philadelphia Fed, which remains very weak and indicates a slowdown in this indicator. At the same time, the number of initial jobless claims increased, but less significantly than expected, indicating a general downward trend in these statistics, which to some extent compensated for the negative effect of a decline in manufacturing activity in the United States.

Fig. 1. Philadelphia Fed manufacturing index chart

The US dollar index remains under pressure from negative sentiment after the Fed meeting, limited to oversold. Relatively weak statistics on the US increased the pressure on the American dollar and pessimism in the stock markets, which at the opening of trading in the US could resume selling the dollar. The expected trading range for the American dollar is from 96.50 to 96.20-00.

Fig. 2. The US dollar index chart. Current price – 96.30

Read also: “Some Formations for Earnings in Financial Markets”

Andre Green

Earn with the help of the trade service on the news Erste News!

Topical articles of the trader’s blog:

- Safe assets and how to trade them in the Forex market.

- Risky assets and how to trade them in the Forex market.

- USA VS China – what means a delay in trade opposition.

Current Investment ideas: