Data on U.S. retail sales and inflation in Canada

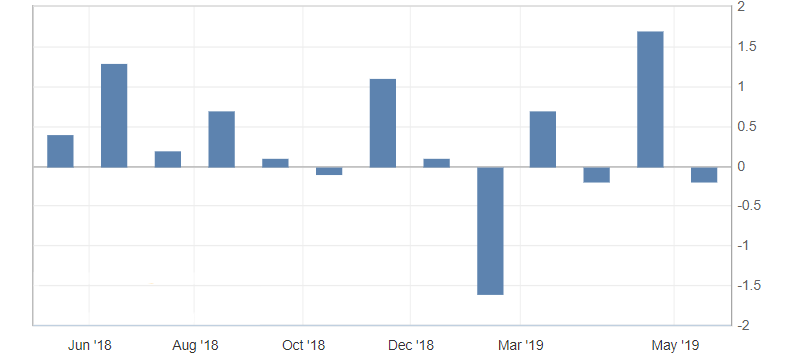

USA:

- Core Retail Sales (m/m) (Apr), fact 0.1%, forecast 0.7%.

- Retail sales (m/m) (Apr), fact -0.2%, forecast 0.2%.

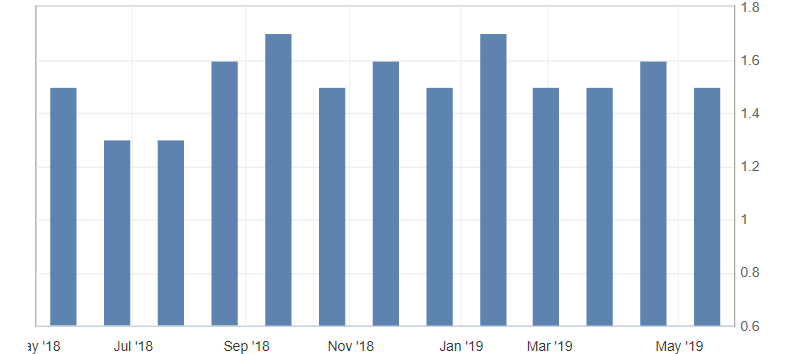

Canada:

- Core Consumer Price Index (CPI) (y/y) (Apr), fact 1.5%, forecast 1.8%.

- Core Consumer Price Index (CPI) (m/m) (Apr), fact 0.0%, previous value 0.3%.

- Consumer Price Index (CPI) (m/m) (Apr), fact 0.4%, forecast 0.4%.

Data on retail sales in the US showed a slowdown in sales in April, which is not strange after a strong growth of this indicator a month earlier. Such dynamics are more related to the consequences of the US-Chinese trade war. Monthly retail sales averages remain positive.

Fig. 1. U.S. retail sales (m m) chart

The data on the consumer price index in Canada, despite growth expectations, slowed down, thereby confirming market concerns about the Canadian dollar, which keeps a downward trend in risks and lower oil prices.

Fig. 2. Core consumer price index (CPI) (y) in Canada

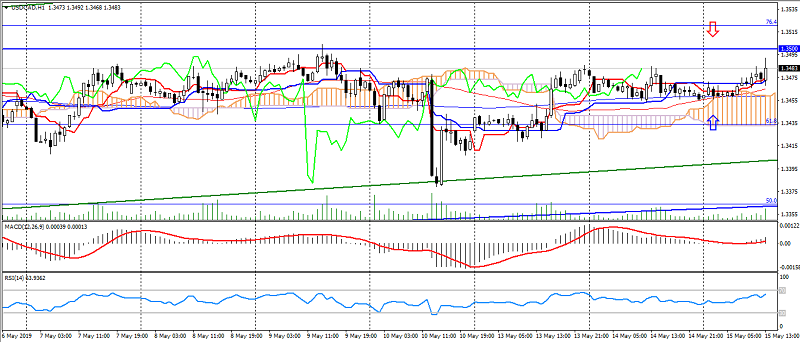

The USD/CAD pair reacted very discreetly to the published data, as the market remains under pressure from risks, but this report supports the US dollar against the Canadian currency, indicating the possibility of a test of significant resistance 1.3500-30. Support is located at the levels: 1.3460 and 1.3440.

Fig. 3. USD/CAD chart. Current price – 1.3480

Read also: “How has the UK economy changed

after the announcement of Brexit and how it affected the pound “

Hanzenko Anton

Earn with the help of the trade service on the news Erste News!

Topical articles of the trader’s blog:

- Escalation of the US-China trade war and what it means for the market

- Skills each investor must develop

- What is interesting about the US Fed meeting in April and how it can affect the world banks policy?

Current Investment ideas: