Eurozone Inflation Data

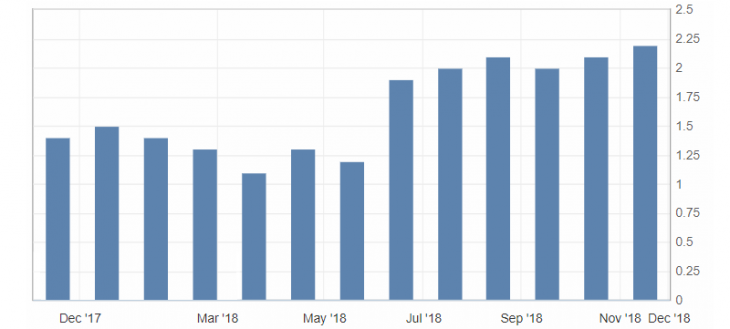

- Core Consumer Price Index (CPI) (y/y) (Oct), fact 1.1%, forecast 1.1%.

- Consumer Price Index (CPI) (m/m) (Oct), fact 0.2%, forecast 0.2%.

- Consumer Price Index (CPI) (y/y) (Oct), fact 2.2%, forecast 2.2%.

An inflation report in the eurozone in October fully coincided with the expectation, putting pressure on the euro. This increase in consumer prices in the eurozone has already been taken into account in the value of the euro.

Fig. 1.Eurozone Consumer price index (CPI) chart (y/y)

The ECB President M. Draghi speech made an additional pressure on the euro. He was very restrained and gentle in rhetoric despite the absence of meaningful statements. Uncertainty about the winding down of the Eurozone incentive program (QE) and very pessimistic expectations increased the pressure on the euro.

As a result, the EUR/USD pair was under pressure from the correction, despite the positive opening of trading on European stock indices. This pair is limited by the upward channel, and the weakening of the euro is likely to be limited to support levels: 1.1330 and 1.1310-00.

Fig. 2. EUR/USD chart. Current price – 1.1330

Read also: “Market makers – who are they and whether they are a threat to the trader?”

Hanzenko Anton

Earn with the help of the trade service on the news Erste News!

Topical articles of the trader’s blog:

- The Australian dollar (AUD) is in anticipation of the annual correction! What to expect?!

- Dow Theory – Averages must confirm each other!

- Market activity depending on the days of the week

Current Investment ideas: