U.S. business activity data (PMI)

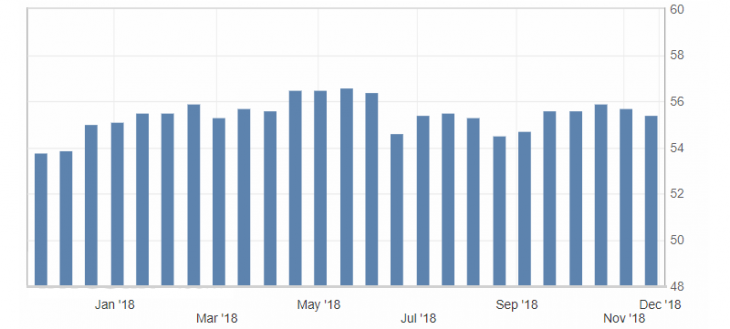

- Manufacturing PMI (November), fact 55.4, forecast 55.8.

- Business activity index (PMI) in the services sector (November), fact 54.4, forecast 55.0.

Preliminary data on the business activity of PMI in the US turned out to be very negative, showing a slowdown, as well as similar statistics for the eurozone. It is worth noting that activity in the United States, despite the slowdown, shows a less significant decline, especially in the manufacturing sector.

Fig. 1. The US Manufacturing PMI chart

The US dollar index almost ignored weak US statistics, continuing to receive support from rising risks. The US dollar index has updated a maximum of a week, but is also limited by overbought and resistance in the range from 96.80 to 97.00, in which a reversal of the correction is possible.

Fig. 2. The US dollar index chart. The current price is 96.80 (10-year government bonds yield is the blue line)

Read also: “Elliott Waves Theory: Prediction of the Correction and Channel Formation”

Andre Green

Earn with the help of the trade service on the news Erste News!

Topical articles of the trader’s blog:

- An engulfing strategy. A Trend reversal.

- Gold is limited to annual correction! What to expect?!

- The Australian dollar (AUD) is in anticipation of the annual correction! What to expect?!

Current Investment ideas: