Oil is trading below the zero mark in the Asian session.

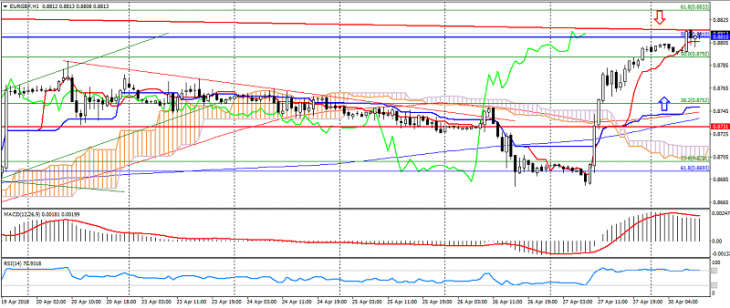

Brent chart (current price: $ 73.52)

The Brent is trading below the zero mark during the Asian session.

- Resistance 1: From $ 75.00 (psychological level)

- Resistance 2: From $ 76.00 (psychological level)

- Support 1: From $ 72.90 (technical level)

- Support 2: From $ 71.70 (technical level)

Computer analysis: The Stochastic Oscillator movings on the H1 chart indicate the oversold of the instrument, against which the Brent price may recover.

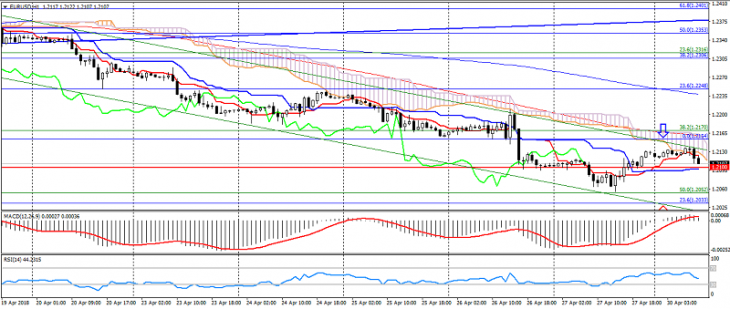

WTI chart (current price: $ 67.86)

The WTI brand is trading below the zero mark during the Asian session.

- Resistance 1: From $ 69.35 (April 24 maximum)

- Resistance 2: From $ 68.75 (April 26 maximum)

- Support 1: From $ 67.15 (technical level)

- Support 2: From $ 66.00 (psychological level)

Computer analysis: The Stochastic Oscillator movings on the chart H1 indicate oversold of the instrument, in connection with which the increase in the price of WTI is possible.