Technical analysis of cross-rates. (Anton Hanzenko)

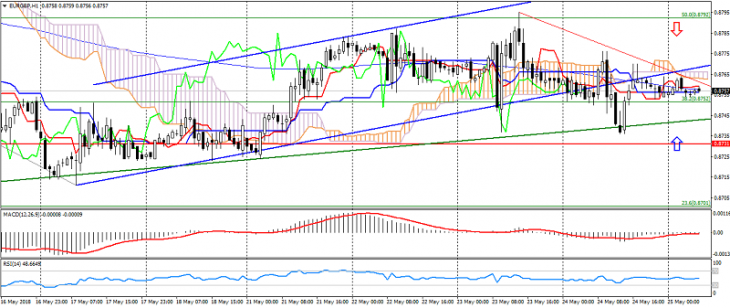

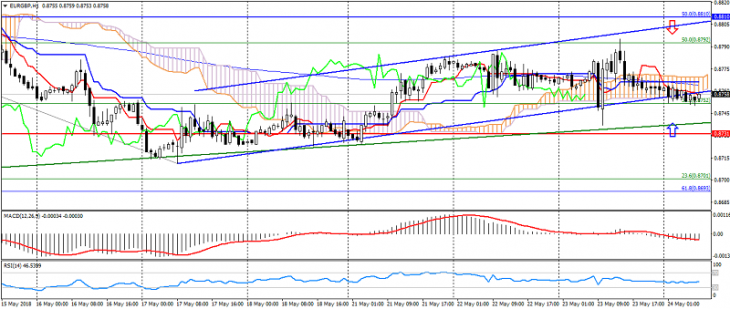

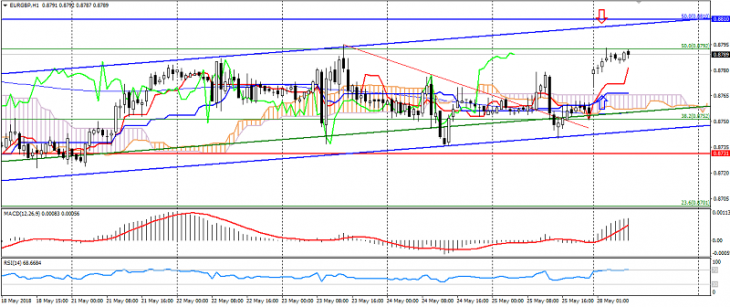

EUR GBP (current price: 0.8790)

- Support levels: 0.8730 (minimum of the last months), 0.8650, 0.8530.

- Resistance levels: 0.8810, 0.8900, 0.9050 (November 2016 maximum).

- Computer analysis: MACD (12, 26, 9) (signal – upward movement): the indicator is below 0, the signal line is in the body of the histogram. RSI (14) is in the overbought zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – upward movement): the Tenkan-sen line is above the Kijun-sen line, the price is higher than the cloud.