Technical analysis of cross-rates. (Anton Hanzenko)

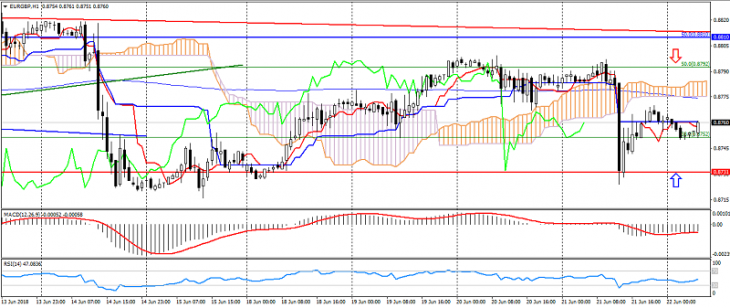

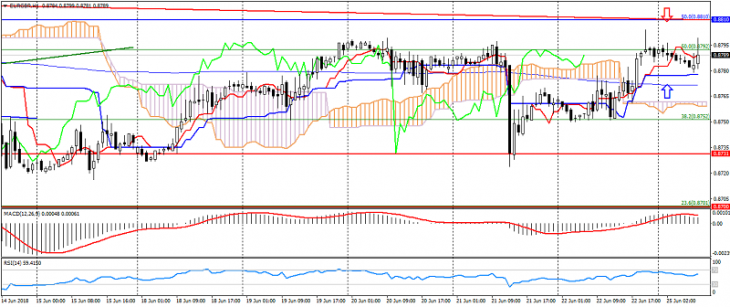

EUR GBP (current price: 0.8780)

- Support levels: 0.8730 (minimum of the last months), 0.8700, 0.8620 (minimum of April).

- Resistance levels: 0.8810, 0.8850, 0.8900.

- Computer analysis: MACD (12, 26, 9) (signal – downward movement): the indicator is higher than 0, the signal line has left the body of the histogram. RSI (14) in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – upward movement): the Tenkan-sen line above the Kijun-sen line, the price is higher than the cloud.