Bloomberg.com — Federal Reserve officials signaled they are set to raise interest rates at their meeting in June, but sent no clear message on whether they’d hike one or two more times this year following that move.

U.S. central bankers said “it would likely soon be appropriate” to increase the benchmark policy rate, according to a record of their May 1-2 meeting released Wednesday, confirming investor expectations for a move next month. Beyond that, officials “expressed a range of views on the amount of further policy firming that would likely be required.”

“It seems like they couldn’t agree on anything beyond the next meeting,” said Stephen Stanley, chief economist at Amherst Pierpont Securities LLC in New York. “They’re really, truly going to be taking this one meeting at a time.”

Inflation rose at the committee’s targeted pace of a 2 percent annual rate in March, yet officials were cautious on whether that was sustainable given that prices had been mostly below that goal for the past six years.

“It was noted that it was premature to conclude that inflation would remain at levels around 2 percent, especially after several years in which inflation had persistently run below the committee’s 2 percent objective,” the minutes said.

The commentary was somewhat unusual given the data in hand: unemployment at the lowest level in 17 years, wages gradually moving higher and the economic expansion apparently on a firm footing.

“There was very little concern about overheating and inflation overshooting too much,” said Julia Coronado, president of Macropolicy Perspectives LLC in New York. “There was more concern that the recent progress cannot be sustained.”

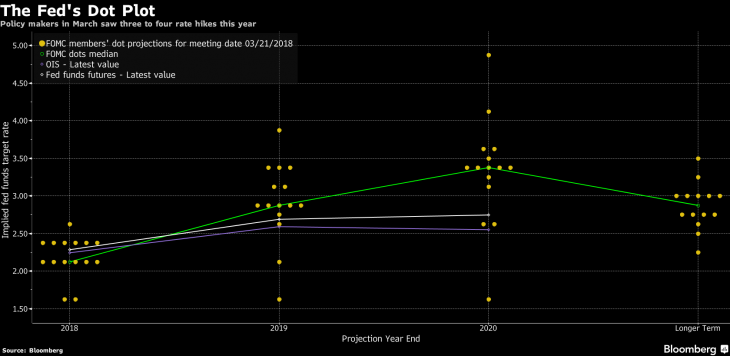

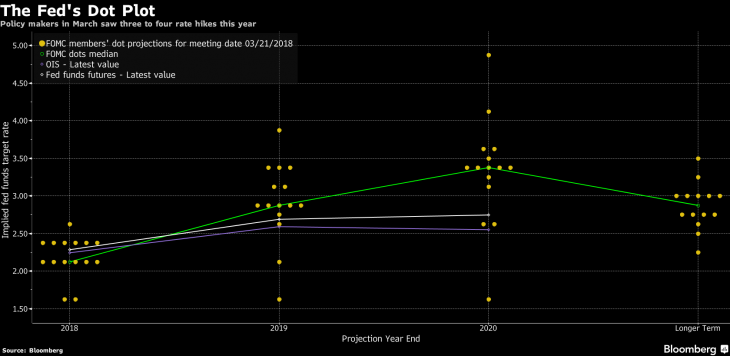

March forecasts by the Federal Open Market Committee showed the committee split between three and four hikes this year, excluding three outliers. That outlook will be updated at the FOMC’s June 12-13 meeting, after which Chairman Jerome Powell holds a press conference.

As noted in their May 2 statement, which inserted a second reference to their “symmetric” inflation target, the committee said it wouldn’t be concerned if inflation overshot the target.

A temporary period of inflation “modestly above 2 percent would be consistent with the committee’s symmetric inflation objective and could be helpful in anchoring longer-run inflation expectations,” the minutes said.

“They could have sounded a lot more optimistic about the economy, and confirmed expectations for four increases this year, but they didn’t do that,” said Michael Hanson, chief U.S. macro strategist at TD Securities in New York. “This is a committee that feels like it has been head-faked one too many times on inflation.”

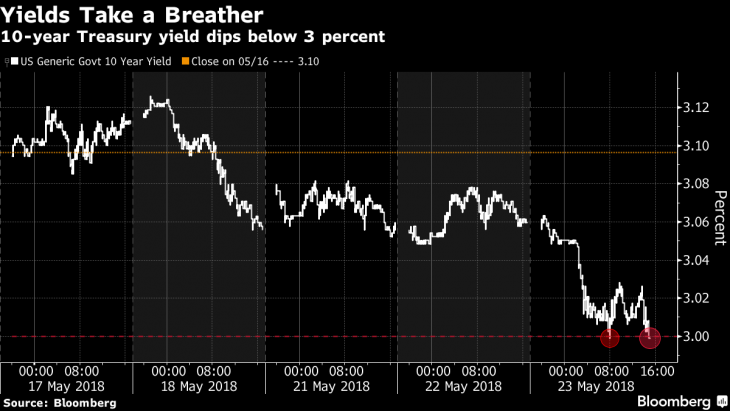

Since the May meeting, the dollar has continued to strengthen, oil prices are higher, and 30-year mortgage rates have also moved up. Tightening U.S. financial conditions have been felt sharply in some emerging markets, with Argentine and Turkish currencies retreating sharply.

Fed officials have little foresight into what exiting from post-crisis, ultra-easy monetary policy will mean for the U.S. economy — let alone the rest of the world — and that may be one reason why they are reluctant to look beyond the next meeting.

“The closer you get to a normal monetary policy, the less agreement you’re going to have about continuing to slog along,” Stanley said. “I’m a little bit surprised that that discussion seems to be drawing so much disagreement already.”