The euro has moved away from the lows of 6.5 months, Italy is trying to calm investors

TOKYO, May 28 (Reuters) – The euro retreated on Monday from a six-and-a-half month low against the dollar, taking a breather after the Italian president tried to dispel investors’ concerns about political instability in the country, although currency growth limited the prospect of new elections .

The euro strengthened by 0.6 percent to $ 1.1725 after falling to $ 1.1646 on Friday, the lowest level since mid-November, as a result of which it lost more than 1 percent per week.

In relation to the Japanese yen, the single currency rose by 0.7 percent to 128.33 yen after a decline to Friday’s 11-month low of 127.165.

The euro was apparently supported by the fact that Italian President Sergio Mattarella refused to approve Paolo Savona, the Minister of Economy, as a tough critic of the single European currency. Two populist parties, trying to form a coalition government, insisted on his appointment.

The prospect of holding new elections in the country due to the refusal of the parties “League” and “Five-Star Movement” from the plans for forming an alliance, however, limited the growth of the euro.

The dollar index, which tracks the dynamics of the US currency against a basket of six major competitors, was trading at 93.871 at 08:45, 0.3 percent lower than the previous close. On Friday, it rose to 94,248, the maximum mark since November 14.

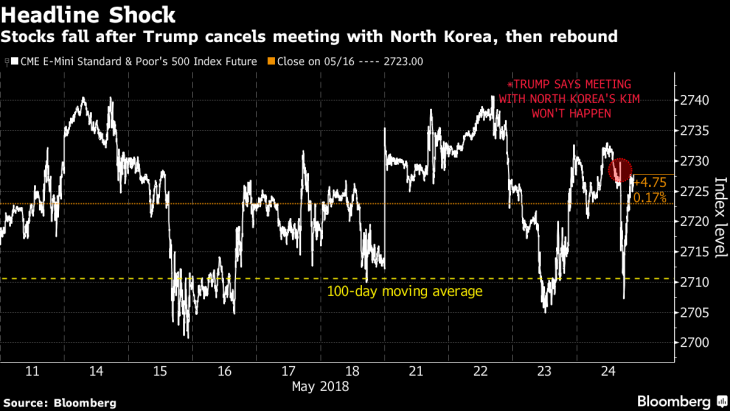

The US currency appreciated by 0.08 percent to 109.47 yen after rising to 109.830 amid a slight decrease in risk aversion after US President Donald Trump said on Sunday that the US delegation had arrived in North Korea to prepare for the planned meeting of Trump with North Korean leader Kim Jong-un.

The Australian dollar strengthened by 0.38 percent to $ 0.7578 after a 0.4 percent drop on Friday.

The New Zealand dollar, which lost 0.2 percent on Friday, rose by 0.6 percent to $ 0.6958.

The Canadian dollar widened Friday’s losses, touching the C $ 1.2992 mark for the dollar, the low since May 8.