As Trump Riles Europe on Trade, Putin Offers More Natural Gas

Bloomberg.com — As Donald Trump’s trade policy risks worsening economic conflict with the European Union, Russia’s Vladimir Putin is strengthening ties with the region.

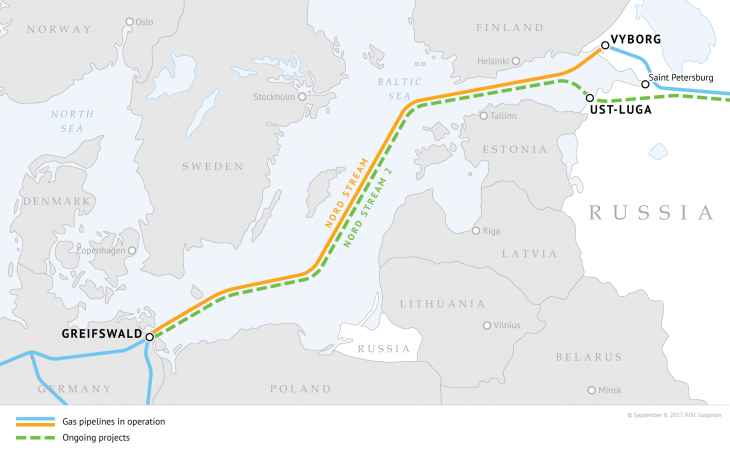

Putin will mark 50 years of gas exports to Europe at an event in Vienna on Tuesday. A controversial 9.5 billion-euro ($11 billion) pipeline to feed more supplies from Siberia directly into Germany is progressing despite a U.S. sanctions threat. And Moscow-based Gazprom PJSC last month settled a seven-year-old pricing dispute with the European Union, enabling it to expand its market share.

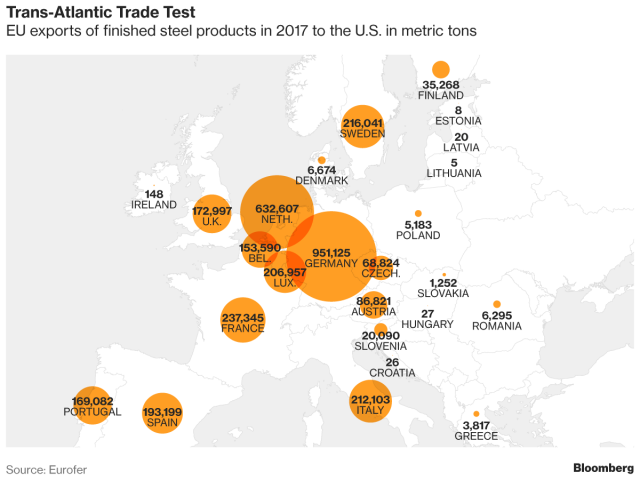

Russia’s success in tightening its grip on Europe’s fuel supply contrasts with friction in the trans-Atlantic relationship, after the U.S. president’s decision to pull out of the Iran nuclear deal and slap tariffs on steel imports. Those moves have left the European partners in the new Russian pipeline wondering whether they can get around any sanctions that Trump deploys.

“Trump is forcing the Europeans closer to the Russians,” Stefan Meister, Russia expert at the German Council on Foreign Relations in Berlin, said in an interview. “This is playing right into Putin’s hands.”

U.S. officials also are making the rounds in Europe, with less impact. State Department envoys have appeared in Berlin, Copenhagen and Brussels in recent weeks warning that the Gazprom-sponsored Nord Stream 2 pipeline will leave Europe too dependent on Russia for its energy supply.

They were spurred into action after Germany and Finland granted construction permits, allowing five boats to begin dredging along the 1,220 kilometer route. This summer, 24-ton sections of steel pipe will be lowered into the sea. Work may be complete by the end of next year, in time for the expiration of Gazprom’s current transport deal with Ukraine’s NJSC Naftogaz in 2020.

The American are threatening sanctions to stop the work. They’re concern is that the new route will allow Russia to bypass the existing transport corridor running through Ukraine, depriving that nation of crucial revenue.

While those views have gained traction mainly in eastern Europe, top EU officials dismiss sanctions as a way of solving problematic issues. At an event in Brussels, European Commission Vice President Maros Sefcovic signaled the EU may protect the companies financing Nord Stream 2. Those include Royal Dutch Shell Plc, BASF SE’s Wintershall unit, Uniper SE, OMV AG and Engie SA.

“I would prefer if we can discuss the issue with the Americans,” Sefcovic said on May 25.

Meanwhile, relations at least on the gas front appear to be warming between Europe and Russia. Gazprom bowed to the EU’s interpretation for how the gas market should work in settling a priceing dispute last month. French President Emmanuel Macron and German Chancellor Angela Merkel joined Putin last month at a forum in St. Petersburg — and echoed some of his concerns about the damaging impact of sanctions and trade tariffs.

Not all European nations agree on the need for another Russian pipeline. Poland, Slovakia and Ukraine, which have for years moved Russian fuel via existing pipelines laid through their territories, object to such a bypass.

Alternative Sources

Europe has few alternatives to taking Russian gas. From the U.K. to Germany and Italy, governments are shutting down coal plants to meet the world’s most ambitious targets for slashing pollution and greenhouse gases. Wind and solar farms are filling some of the gap, but gas is the cleanest fuel to balance the grid on calm days or when the sun doesn’t shine.

Austria’s OMV, which signed a groundbreaking gas deal with the Soviet Union in 1968, called the Russian supplies “reliable.” Looking ahead to Putin’s visit to Vienna, OMV CEO Rainer Seele and Gazprom boss Alexey Miller hinted in a joint statement at “expanding the partnership” and say they “plan to reach a new level of strategic cooperation.”

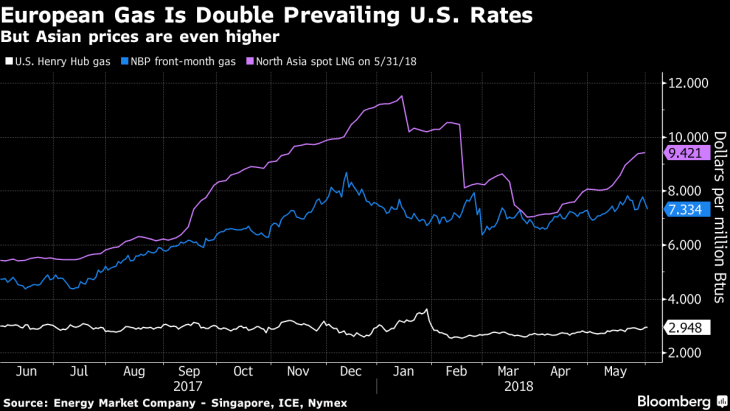

The American suggestion is that Europe should take U.S. exports of natural gas in its liquid form. That requires expensive technology. And it wouldn’t prevent exports going to Asia where prices are even higher than Europe’s.

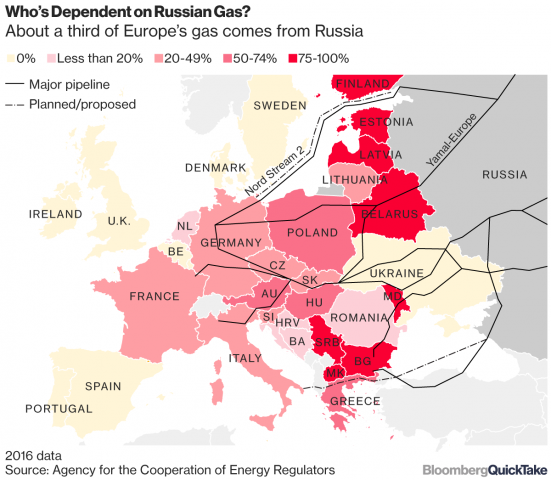

Washington’s concern is that Putin has lured Europe into dependence and is using gas as leverage to advance his political agenda.

“For Russia, it’s clear to us that gas is not simply a commodity to be traded — it’s a foreign policy tool and a weapon,” said Adam Shub, an official at the U.S. mission to the EU in Brussels.

It isn’t clear just how far the U.S. would go in holding up Nord Stream 2. Full sanctions against the project’s participants could prevent them from doing business in the U.S., a potentially fatal blow for companies like Shell with major U.S. operations. It could have more tailored moves, like a travel ban for executives, or ratchet up pressure slowly by asking the State Department to draw up a list of measures under consideration.

“Sanctions are a potential lightning bolt in the refinery,” said Richard Nephew, an expert on energy sanctions at the Center on Global Energy Policy at Columbia University in New York. “The companies have been thinking and planning around sanctions risk for a long time. The companies can do a few things to de-fang the U.S.”

Depending on the shape of the sanctions, the sponsoring companies might be able to set up independent legal entities to do the work, circumventing whatever Trump wants to impose, Nephew said. American officials may also lean on Sweden and Denmark to refuse construction permits. With Denmark at least, Nord Stream 2 has a plan to rejig the route and avoid those waters.

Regardless, Russia already supplies more than a third of Europe’s gas, and that portion is growing. It’s the biggest single supplier of the fuel, and Gazprom’s shipments to the continent reached a record last year. They’re on track to rise again in 2018 as a chilly winter drove up heating demand and left the content’s storage tanks depleted.

Russia for its part has always denied it uses gas as a weapon, noting that the fuel kept flowing all through the worst parts of the cold war. For Gazprom’s biggest customer in Europe, Nord Stream 2 is an essential piece in Europe’s energy system and necessary to satisfy increasing demand for gas.

“It’s strategically very important for the European market, for our customers – and we have an obligation to serve our customers reliably with gas,” Klaus Schaefer, chief executive officer of the German utility Uniper SE, said in an interview in St. Petersburg on May 25. “We are very supportive.”

— With assistance by Anna Shiryaevskaya, Brian Parkin, and Boris Groendahl