Analysis of the past week

The passed week, despite the news, turned out to be very calm in terms of trade and ended in a lateral trend for most currency pairs. So, according to the results of the week, commodity currencies close with small growth week-long trades due to the positive dynamics of stock indices and raw materials, and safe haven assets due to the growth of political risks in the eurozone and the United States.

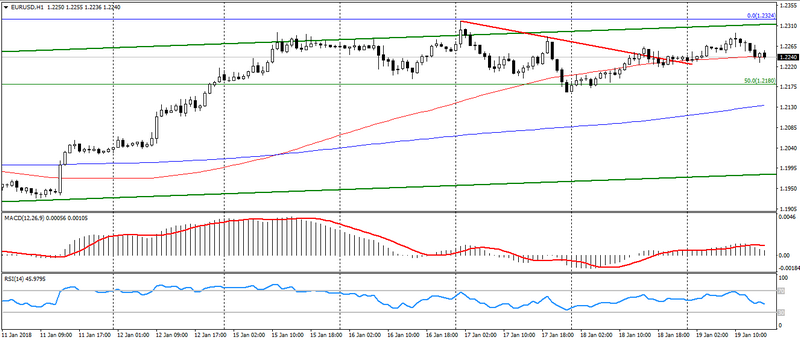

The euro almost a week traded in a sideways trend, thereby indicating a slowdown in the uptrend in the pair EUR/USD. In addition to the considerable oversold of the pair, slowing of the growth of the euro was caused by the data that Germany failed to create a ruling coalition. As a result, the possibility of repeated parliamentary elections in Germany has increased dramatically.

Also for a week a number of speeches were held by the representatives of the ECB, who, despite optimism regarding the curtailment of the incentive program, spoke out negatively about the possibility of raising rates in the euro area.

As a result, this slowdown in the growth of the EUR/USD pair may indicate a correction or even a trend reversal.

Fig. EUR/USD H4. The current price is 1.2240.

Regarding the US currency, the situation is also very mixed, despite the fact that the US dollar index was able to grope support near psychology at 90.00, the downward trend remains, thereby confirming the possibility of a further decline in the dollar, which is also indicated by political risks in the US.

Graph of the US dollar index. The current price is 90.30.

Hanzenko Anton