Analysis of the past day

The new trading week opened with a resumption of growth of the US dollar against a basket of competitors on Monday. At the same time, at the start of the day, there was a decrease of the American dollar on the growth of optimism. The reason for the renuwal of the US dollar strengthening of was the resumption of risks in the eurozone and the UK.

Stock indices were trading in different directions (Nikkei 225 +0.40; DAX -0.10; FTSE 100 +0.20; Dow 30 -0.10), starting the day with growth on maintaining Friday optimism, and closing the day with a decrease on negative the opening of the American session, which was caused by the resumption of risks.

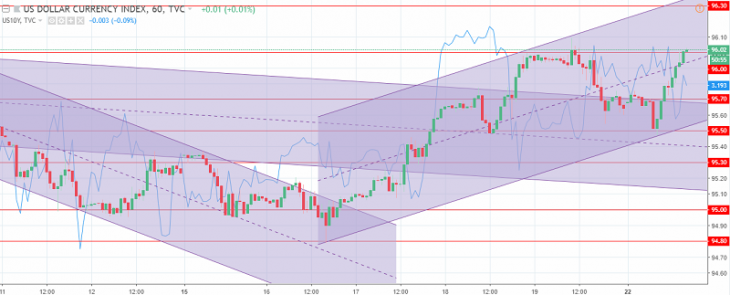

The dollar index closes the day near the highs of the past week, confirming the uptrend, which is limited to psychology 96.00. Further preservation of this trend opens the way to resistance levels: 96.30 and 96.50. Support is the mark: 95.70-60.

The US dollar index chart. The current price is 96.00 (10-year government bonds yield is the blue line)

Hanzenko Anton