Analysis of the last week

The second week of December was distinguished by a significant number of publications of the Central Bank’s protocols and statistics, which caused a significant increase in volatility in the market.

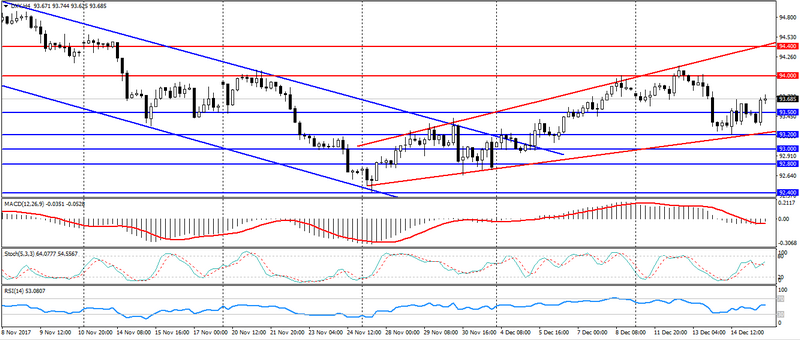

The main expected event of the week was the publication of the minutes of the meeting of the US Federal Reserve. As a result, the key interest rate was increased by 25 bp., but, despite this, the US currency has weakened across the entire spectrum of the market. The sale of the American was caused by the fears of a relatively low rate of inflation, which could negatively affect the prospects for higher rates in the future. As a result, the dollar index was under considerable pressure and updated the minimum of the current week, thereby significantly expanding the uptrend on the US dollar index.

The graph of the index is the US dollar. Current price – 93.700

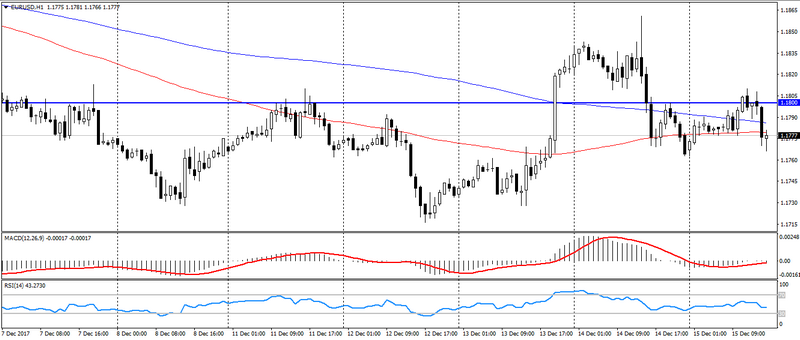

The second, but not less significant event was the publication of the ECB protocol and the press conference of the head of the ECB Draghi, according to which the monetary policy of the eurozone was maintained at the same level, and expectations for GDP growth for the coming years were revised upward. But, despite very positive notes, the single currency weakened across the entire spectrum of the market, which was caused by restrained rhetoric and readiness to expand the quantitative easing program if necessary.

As a result, the pair EUR/USD, after short growth attempts, sharply weakened, thereby questioning the safety of the uptrend in the pair, which was traced at the beginning of the week. Also, the overall decline in the euro played into the hands of the American and other world currencies.

Fig. EUR/USD. The current price is 1.1770.

Hanzenko Anton