Analysis of the last week

The last week of autumn brought a lot of statistics, but even more high-profile statements. So, last week the negotiations between Great Britain and the EU on Brexit moved from a dead end. As a result, the pound gained strength across the entire spectrum of the market, as the market took the news as very positive for the pound and less positive for the euro. Of course, it’s only going to be about compensation and it’s likely to be heard for a long time, but now the market is starting to prepare for a softer Brexit than a week earlier.

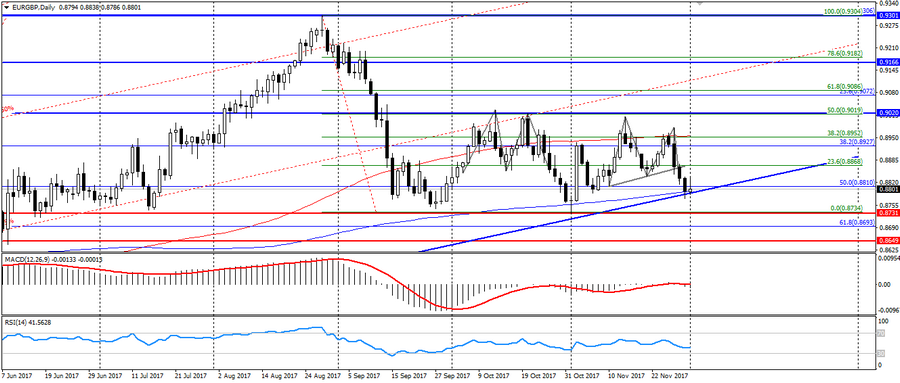

This is indicated by the dynamics of the cross-rate EUR/GBP, which after a two-month flat began to form a movement towards strengthening of the British, despite the maintanance of the uptrend.

EUR/GBP D1. The current price is 0.8800.

Also, during the week a lot of news on the US came out, but the main news was related to voting on the tax reform in the United States and the resignation of the Secretary of State of the White House. Thus, the expectations of voting on tax reform in the US de facto provided support to the American and resumed optimistic expectations for the American, despite the fact that the final text of the reforms can be changed as necessary. A negative note was the withdrawal of Secretary of State Tillerson because of political differences with Trump, which increased political concerns about the US dollar.

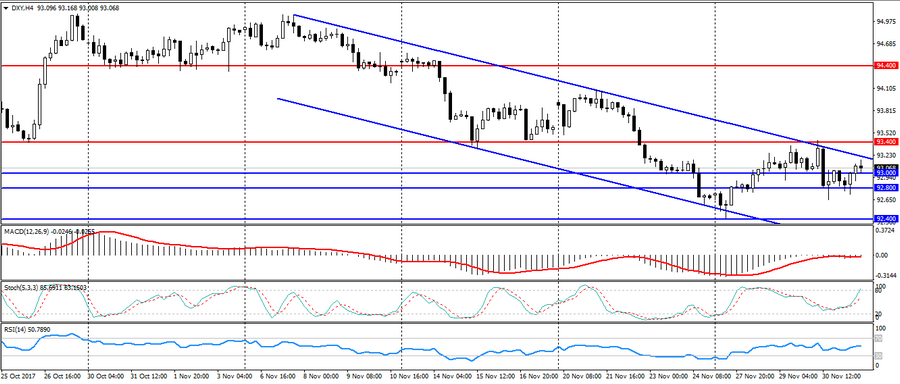

Despite this, the dollar index closes the week with a small plus, but it keeps downward dynamics.

The US dollar index H4. Current price – 93.050

Hanzenko Anton