Analysis of the last week

The past week was full of important news, but the main driver of the trades remained political risks and fears caused by them. If to omit the overall decline in the US currency at the beginning of the week based on the negative sentiment caused by the tax reform in the US, one can say that the trades this week were held in a sideways trend.

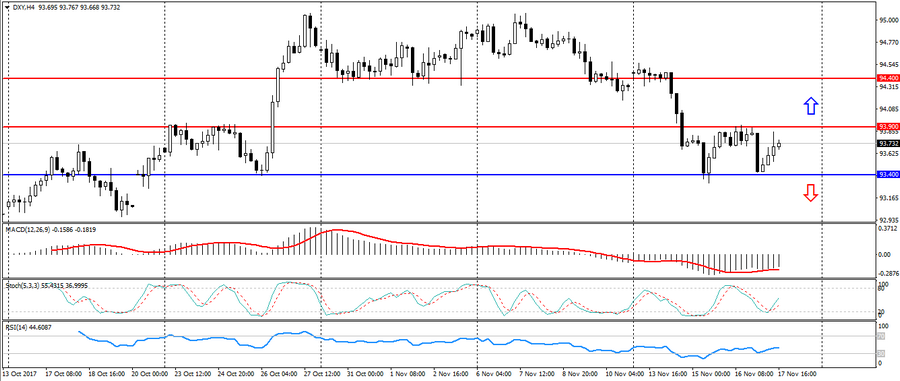

Over the past week, the dollar index has updated minimum of four weeks at the level of 93.400, which was caused by data on inflation in the US and the rising risks on the world stage.

As a result, the US dollar index was completely corrected after working out the figure “inverted head and shoulders” on the daily timeframe. The flat weekly movement calls into question the safety of the uptrend, which is seen from September. The level of 94.000 is an important psychology, and consolidation above it will indicate the preservation of an upward trend in the US dollar index. Otherwise, fixing the index below the level of 93.400-500 will indicate a reversal of the general uptrend.

Hanzenko Anton