Analysis of the past day

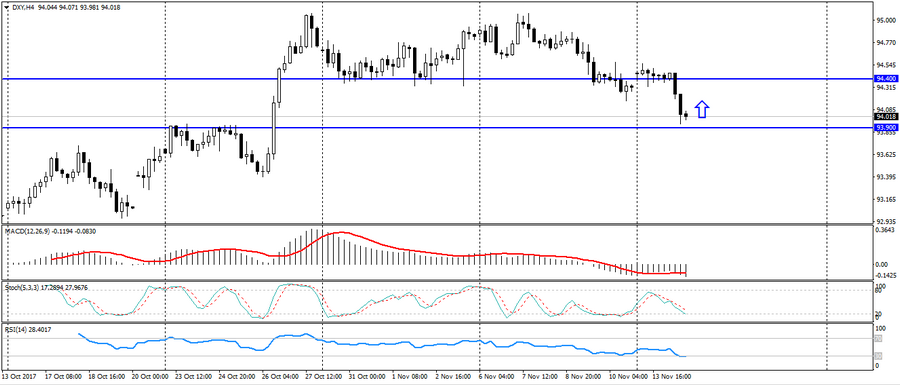

On Tuesday, November 14, the US dollar index continued to weaken across the entire spectrum of the market, remaining under pressure of uncertainty caused by the timing of the implementation of the tax reform in the US. As a result, the US dollar index updated the minimum of three weeks.

The American was reduced because of the general strengthening of the euro against the backdrop of positive statistics on GDP in Germany and the eurozone, which led to the strengthening of the single currency in crosses. Additional support for the euro was provided by flat inflation data in the UK, which also affected the EUR/GBP cross.

As a result of today’s trading, the dollar index approached a significant support level of 93.900-94.00, near which it found support. This area is a key one, especially given the upcoming data on inflation in the US. Therefore, until tomorrow’s statistics on inflation in the US, a restrained correction from this support zone is expected.

Anton Hanzenko