An analysis of the previous day

On Monday, October 30, the dollar index appreciably weakened against the main competitors. As a result, the index retreated from the highs of the last four months. The main drop in the American was due to the recovery of the single currency and the British pound, which was caused by the expectation of significant statistics on the euro area and the UK. Additional pressure on the American had a negative opening of the US stock indices, which increased pressure on the national currency and increased the demand for safe harbor assets.

The negative sentiment in the market was caused by the absence of new optimistic data on the US, and in case of a negative opening of the Asia-Pacific stock indices, this flight from risks will significantly increase. This, in addition to the yen, will affect the franc and gold.

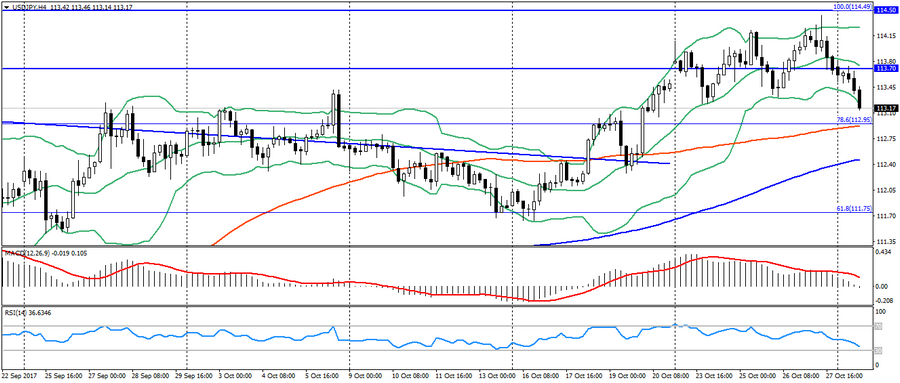

On the pair USD/JPY, a reversal pattern of the double top on H4 is formed, which will indicate a further decline in the pair and the preservation of flight from risks. In order to develop this figure, the pair needs to gain a foothold below 112.90-113.00, which remains a significant support from which it is possible to repel.

Anton Hanzenko