Analysis of the past day

The opening of the new working week was very positive for the US currency, which continued to grow against the basket of competitors. The driver to the growth of the American dollar was an ambiguous Friday employment report in the US, the sale of safe haven assets and the modest decline in stock indices.

Stock markets at the opening of the week showed restrained negative dynamics following the decline in raw material costs and the preservation of geopolitical risks (Nikkei 225 +0.44; DAX -0.50; FTSE 100 -0.10; Dow 30 -0.10).

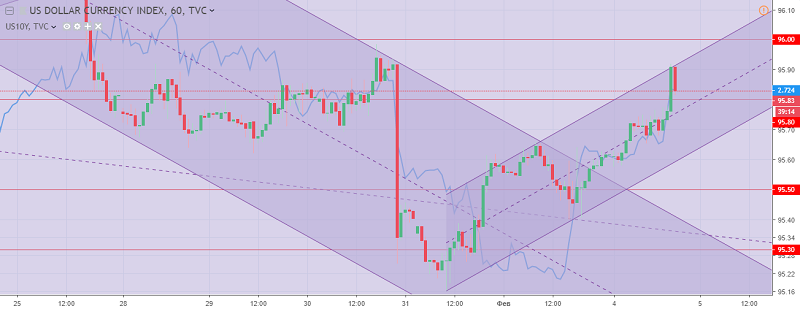

The US dollar index on Monday trades updated the high at the level of 95.90. But after accelerated the decline on weak data on the US and the technical correction on the rebound from the upper boundary of the trade channel. At the same time, the upward trend in the dollar is preserved, but is limited to a correction to support levels: 95.80-70.

The US dollar index chart. The current price is 95.80 (the yield on 10-year government bonds is the blue line)

Hanzenko Anton