An analysis of the previous day

On Wednesday, October 25, the US dollar, after moving in a sideways trend, showed a decline. It was caused by the negative dynamics of US stock indices, despite positive statistics on durable goods and new home sales in the US. As a result, the main pressure on the US dollar was caused by the stock indices, given that the data on the US remain positive and the US Treasurys near the three-month highs. Further decline in the American will be limited, especially based on a positive start of the Asia-Pacific sites.

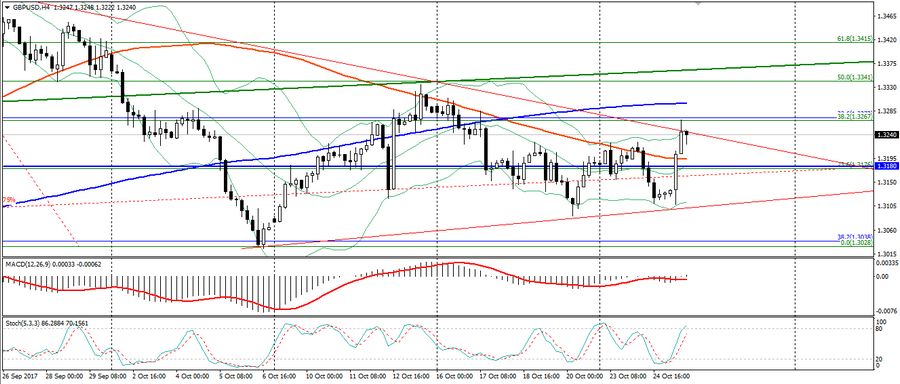

The British pound significantly strengthened across the spectrum of the market on UK GDP data, which turned out to be higher than expected. Thus, indicating the possibility of slowing down the negative dynamics of the British economy. As a result, the pair GBP/USD managed to update the maximum of the week at the level of 1.3270. But this level is also a significant resistance (Fibo, 38.2 from the September maximum). Breaking off from this level will indicate the return of this pair to the lateral triangle and further decrease to 1.3180-50.

Anton Hanzenko