American problems of the Canadian dollar. Trading recommendations for the pair USD/CAD.

Good afternoon, dear traders, investors and other participants

of the financial market and exchange trade. With you, the financial columnist

and analyst of the International Currency Market ForEx – Andrew “Golden Eye” Green.

Yesterday we witnessed the next meeting of the Bank of Canada, next in order and in the absence of any information that could have highlighted it in a special way. The Central Bank of Canada remains cautious in its statements regarding further prospects of raising the discount rate and other mechanisms for tightening monetary policy. The reasons for this caution are sufficient:

- the weakening of the growth rates of oil prices, due to the aggressive growth in the production of alternative oil (shale) at current prices, as well as the use of the fuel resources market as an instrument of political pressure on the part of some of its key participants;

- ambiguous statements by the president of a neighboring state (USA) about possible protectionist actions on the commodity market. Despite the fact that yesterday Donald Trump voiced the possibility that the introduction of tariffs for the import of steel and aluminum does not affect the nearest neighbors, the scandalous nature of the odious policy keeps the possibility of new frictions and complications. And the fact that one of the quieter Gary Cohn came out of his advisers only warms up the uncertainty;

- internal slowdown in growth rates, primarily, the level of wages and increased activity in household lending.

In a word, there is nowhere to expect strong support from the Canadian dollar, whereas the American aggressively comes after the first quarter of the weakening. In addition, it is important to consider the fact that CAD, one of the most sensitive currencies to the main dynamics of USD.

Even in the context of technical analysis – the situation is not simple. But, for starters, let’s start by studying long-term prospects. Let’s look at Figure 1 and the weekly timeframe.

It clearly shows the downward trend channel with the prospect of the nearest re-test of the resistance line, taking into account the above circumstances, as well as the threat of an early 4-fold increase in the Federal Reserve rate in the US, a breakdown is very likely. But while it did not take place – do the main accents on the reversals.

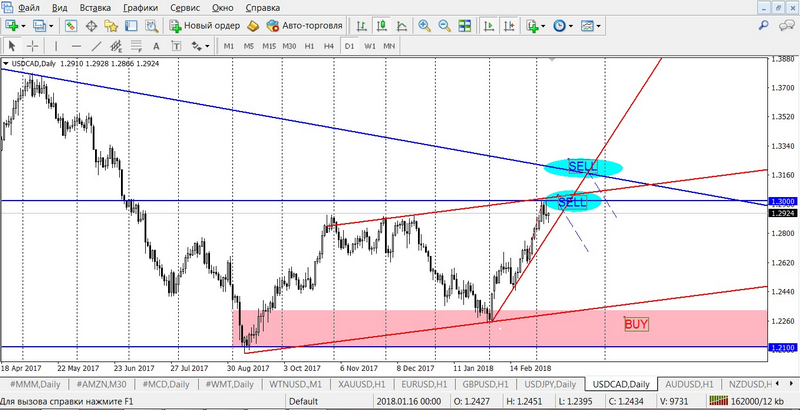

The mid-term analysis in Figure 2 also highlights the need for sales, mainly from levels 1.3000 and 1.3200. And, as for me, aggressive sales with short stops are very interesting.

For trading during the day and until the end of the week, the main focus on H4, this timeframe is the most convenient, in my opinion, for Intraday trading on this pair. In Figure 3, you see a change in sentiment from the emphasis on sales from senior timeframes for purchases.

The main guidelines are psychological support zones at 1.2700, 1.2500, 1.2300.

Examples of transactions:

- conservative option:

BUY limit 1.2700, SL 1.2660, TP 1.2760,

BUY limit 1.2500, SL 1.2450, TP 1.2580,

SELL limit 1.3200, SL 1.3250, TP 1.3120. - aggressive option:

BUY limit 1.2900, SL 1.2860, TP 1.2960,

SELL limit 1.3000, SL 1.3060, TP 1.2920.

The greatest pleasure is not to reach the goal when you walk with the wind in the back,

but when you overcome obstacles in your path.

Andrew Green