THE MAIN PATTERNS FOR EARNING IN THE FINANCIAL MARKETS! PART 2. ANTON HANZENKO.

Continuing the topic about the patterns in the financial market, begun in the previous article, we couldn’t mention other very important patterns.

The flag

Flags can be divided into two subspecies: the flag and pennant. This is a conditional division, since in different literature these figures can occur both in one subspecies and in completely different classifications.

The flag – is the continuation pattern.

The flag pattern consists of a flagpole or handle, which is formed after a strong trend, and the flag canvas itself (body) on the price chart is shown as a parallel channel. The channel itself can be both horizontal and with a slight slope. When a flag pen is formed, trading volumes increase, while the price moves inside the flag canvas, the volume decreases, and when the price leaves the flag canvas, the volume increases.

The pattern shows an example of an inverted flag (which indicates a continuation of a downtrend), where, after a strong downtrend (a flag stick) a long side trend is formed – the flag canvas. The price breaking through the channel borders in the direction of the trend, on which the flag pen was formed – the flag canvas is the entry signal into the deal. The goal is usually set at 2/3 of the size of the flag pen, but it also happens that the flag pen is fully worked out.

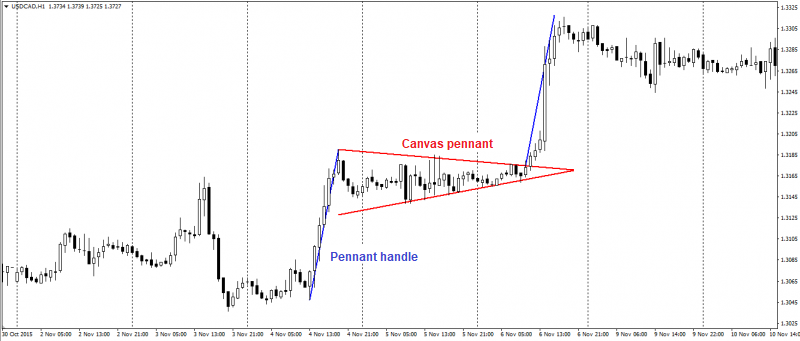

The pennant

The pennant is similar to the flag model and has only one difference: the canvas (body) of the pennant has converging borders in contrast to the flag, whose borders are parallel.

The pattern shows an example of an ascending pennant (which indicates a continuation of the uptrend). Pennant entry points and targets are similar to the flag. For example, the pennant handle worked completely.

The brilliant

The brilliant is a very rare pattern of graphical analysis, but no less effective. The pattern itself is a multidirectional price fluctuation that grows towards the middle of the figure and decreases towards the edges, forming a rhombus or a brilliant. A brilliant, as a rule, has the same or similar in size and indicates a trend reversal.

The goal of a brilliant is equal to the distance from the minimum to the maximum, deferred from the point of breakthrough in the opposite direction from the previous trend.

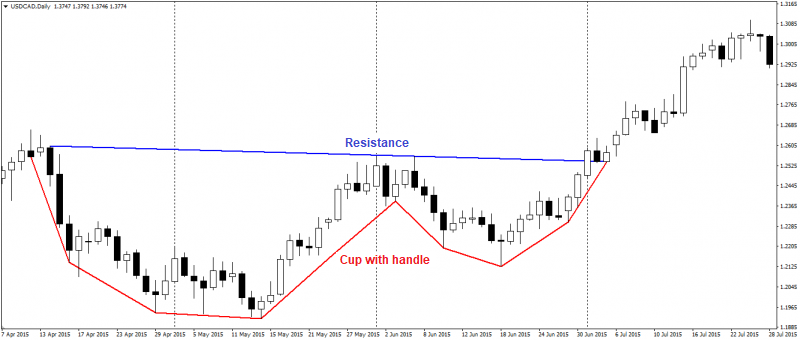

A cup with handle

A cup with a handle or a cup is a pattern of the continuation of an uptrend. This pattern consists of two parts: the cup or body of the cup and the handle. The cup itself is a concave trend channel in which the price moves. Then a handle comes – a smaller concave trend channel. The beginning of the concave channels of both parts of the pattern is approximately at the same level and serves as resistance.

The entry point into the deal is the breakthrough of the resistance level, and the minimum goal is equal to the distance from the minimum of the handle to the resistance level.

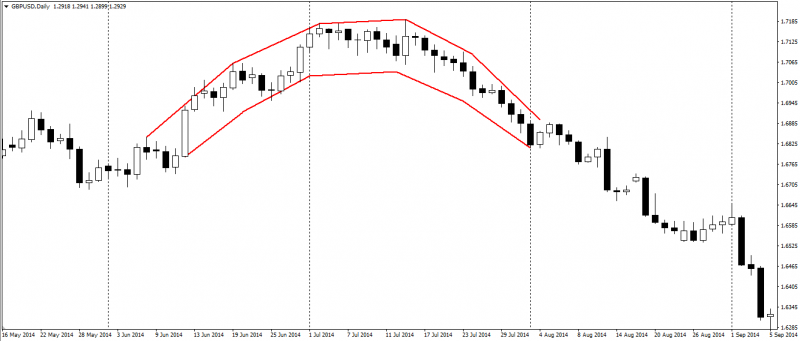

A saucer

A saucer is a trend reversal pattern, it is very rare. A saucer is a curved trading channel that can form for a long time. The longer is the saucer, the higher is the likelihood of its proper working out.

It is conditionally possible to draw a line of support, resistance from the beginning to the end of the saucer and calculate the expected profit from it, but the main difficulty lies in the fact that until the final formation of the saucer it is not known where the end of the pattern is. Therefore, when using this pattern, you need to be extremely careful.

You can learn more about these patterns and not only from the training course offered by the company Holding Holding Inc.

ANTON HANZENKO