Emerging markets and their prospects: Mexican Peso (MXN)

We continue the series of articles about the emerging markets, we were talking about the South African rand, and today we will talk about the Mexican peso, which became very popular among investors, after statements by US President Trump about tightening foreign policy towards Mexico.

Economic data of Mexico

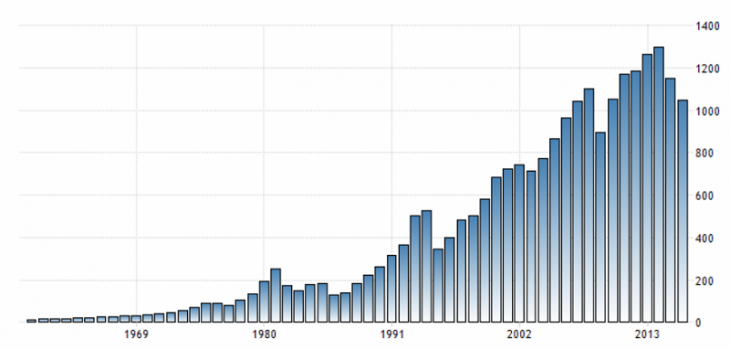

The economy of Mexico is characterized by a steady growth in GDP since 1990. Even the crises in the 2000s had little impact on Mexico’s overall GDP dynamics.

Fig. 1. Mexico’s GDP Chart

The main reason for the stable growth of the economy of Mexico was oil. The oil industry remains the leading branch of the Mexican economy. As a result, the Mexican peso is a commodity currency, but more on that later.

Mexico enters the free trade zone with Canada and the United States (NAFTA), but with the coming to power of Donald Trump, US policy on foreign trade has changed a lot, which also affected the Mexican peso.

Features of trading on the peso

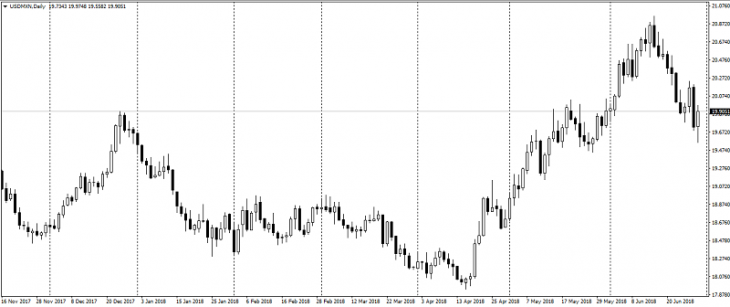

Like the South African rand, the Mexican peso has very high volatility against the US dollar. This makes it an excellent tool for intraday trading. Unlike “majors” pairs the USD / MXN is more unidirectional and observes trend dynamics, which rarely changes during the day.

USD / MXN Chart

Because the Mexican peso is a commodity currency that depends on the dynamics of oil. When trading on USD / MXN it is worth paying attention to the dynamics of oil, especially the WTI brand. That is due to the high correlation, especially recently on the wave of rising oil prices.

Fig. 2. Graph of correlation of the pair USD / MXN and oil WTI (blue line)

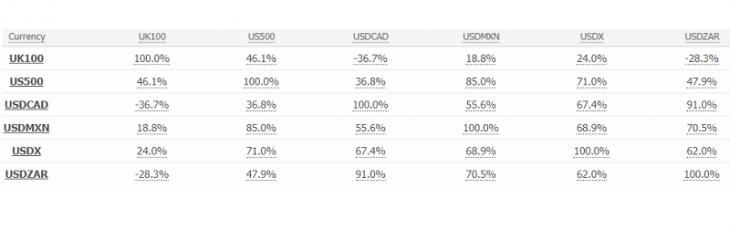

In addition to oil, the peso correlates well with other commodity currencies and not only.

Fig. 3. Correlation table USD / MXN

The second, not less significant factor in the cost of oil is US foreign policy. This was especially evident in Trump’s election statements, which spoke of the complete dissolution of US-Mexico trade relations and the construction of a fence on the border between countries. After that, the Mexican peso was under considerable pressure.

As Mexico enters the NAFTA free trade zone, the revised arrangements under this agreement also put considerable pressure on the peso. On the other hand, the cooling of Trump’s rigid rhetoric about Mexico has stabilized relations between countries.

The outcome

Based on a few simple facts, the pair USD / MXN can become an excellent investment tool. In addition, this pair is well suited to technical analysis and it builds very effective trend strategies, thanks to which many traders trade on it.

Anton Hanzenko