EUR/USD today

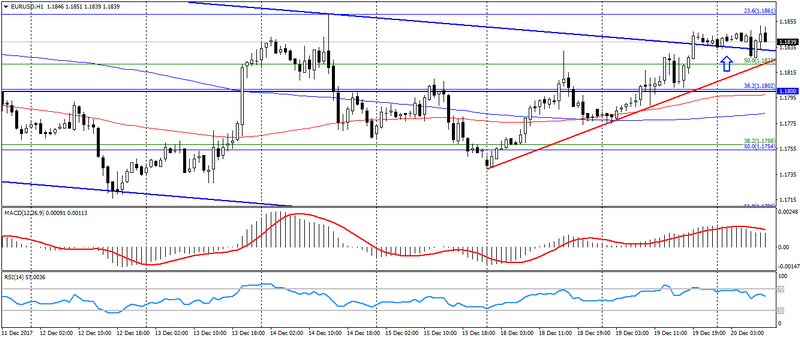

On Tuesday, the pair EUR/USD managed to break the upper boundary of the descending channel, which was caused by the growth of the yield of state bonds of Germany. As a result, the pair maintains a short-term uptrend. Despite the progress of the tax bill in the United States.

Events for today:

- 15:00 – the speech of the President of the Bundesbank, Weidmann.

- 15:15 – Speech by the head of the Bank of England, Carney.

- 15:30 – announcement of the volume of wholesale sales in Canada (m/m), the forecast is 0.5%, the previous value is -1.2%.

- 17:00 – data on real estate in the US.

The day is very full of news, but the market is still focused on data on the promotion of the tax bill in the US. Also, do not forget about the pre-holiday decrease in liquidity, which can cause the growth of volatility in the market.

The pair EUR/USD managed to gain a foothold above the level of 1.1830, which indicated a breakdown of the downtrend and the possibility of further pair growth. But, given the fundamental factors, namely, the adoption of tax reform in the United States, a return to a downward trend is possible. This pair remains in an uptrend and is limited to the level of support 1.1820-30, from which one should expect further growth to resistance levels: 1.1860-70 and 1.1900. The return of the pair below 1.1830-00 will cancel the scenario for strengthening and will open the way to support: 1.1770 and 1.1750.

Fig. EUR/USD. The current price is 1.1840.

Hanzenko Anton