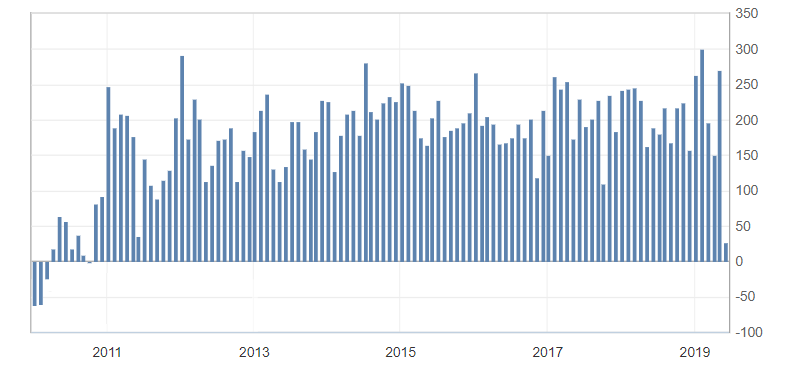

US employment data

- ADP nonfarm employment change (May), fact 27K, forecast 180K, previous value 271K.

According to ADP, the number of people employed in the US non-farm sector has slowed to a nine-year low. This is a very negative signal before the Friday employment report in the United States and puts pressure on the US dollar.

Fig. 1. ADP nonfarm employment changes in the USA

Against the background of low expectations from the upcoming data on employment in the US, the US currency accelerated the decline across the market. The US dollar index broke through the support of 97.00 and is preparing to test the marks: 96.80 and 96.60. In the face of a slowdown in the US labor market, the likelihood of lowering the Fed rates will increase. This will put additional pressure on the American dollar.

Fig. 1. The US dollar index chart. The current price is 96.80 (10-year US government bonds yield is the blue line)

Read also: “Geopolitical risks for the beginning of 2019″

Hanzenko Anton

Earn with the help of the trade service on the news Erste News!

Topical articles of the trader’s blog:

- The main reasons for the weakening of the US dollar. Fed’s rates cut

- Should we expect the currency intervention from the Bank of Japan?

- Political risks in the UK increase the chances of Brexit without a deal

Current Investment ideas:

- Where else, if not on the banking sector! Earn with an investment idea from an Ester company’s expert!

- The best software for earnings on the technology giant’s Microsoft shares is inside! Connect!

- Hewlett-Packard shares are ready to close the gap, and we are ready to close the profits!

- Several reasons to buy Walmart shares. Use the chance to earn!