US production data

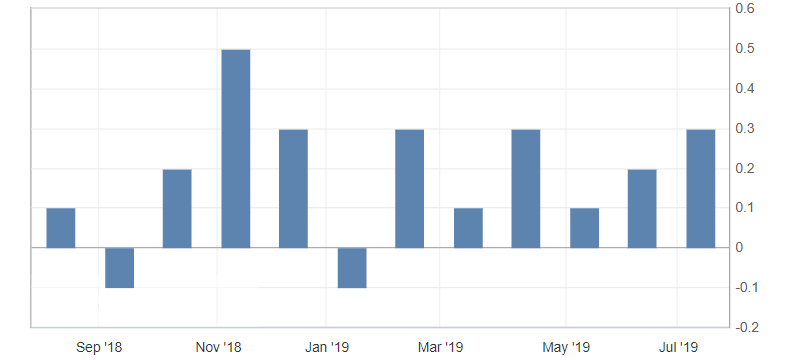

- Core Producer Price Index (PPI) (m/m) (June), fact 0.3%, forecast 0.2%.

- Producer Price Index (PPI) (m/m) (June), fact 0.1%, forecast 0.1%.

Data on producer prices showed an increase, which confirmed positive data on consumer inflation in the United States. Despite the fact that the indicator remains restrained, it indicates the strength of the US economy.

Fig. 1. Core producer price index (PPI) (m m) USA

The US dollar index did not actually respond to the published data, while maintaining a restrained upward trend. In this case, the American dollar is limited to the side channel from 97.10 to 96.90, receiving support from the correction of positions before the weekend and the restraint of the market.

Fig. 2. The US dollar index chart. The current price is 97.00 (10-year US government bonds yield is the blue line)

Read also: “Stock Indices: the US Market”

Hanzenko Anton

Earn with the help of the trade service on the news Erste News!

Topical articles of the trader’s blog:

- The Japanese yen: expectations and prospects.

- US and China return to the negotiation table

- Cryptocurrency market continues the growth data on Libra

Current Investment ideas: