Treasuries Fall, Dollar Rises as Jobs Data Beats: Markets Wrap

Bloomberg.com — Treasuries extended losses and the dollar added to gains after better-than-forecast jobs data raised concern the Federal Reserve may accelerate its tightening schedule. U.S. stock futures remained higher.

S&P 500 contracts rose 0.4 percent after the unemployment rate held at an 18-year low. The dollar was set to push it weekly streak of gains to seven weeks, the most since 2014, and the 10-year Treasury yield rose above 2.90 percent.

The jobs data underscored that the economy is strong enough to withstand a rate hike when the Federal Reserve meets later this month. Investors remain optimistic that threats of more international tariffs will not materialize into an all-out trade war between the U.S. and its key partners.

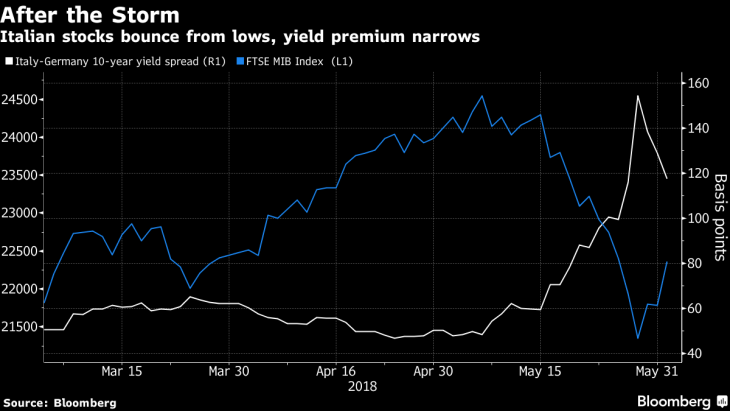

In Europe, stocks were set for the largest gain in a month after Italy’s populist parties grabbed power, ending a three-month political gridlock. The latest developments in Spain also removed uncertainty, providing some well-needed relief overseas. The common currency declined.

The risk-on mood prevailed even as U.S. President Donald Trump’s administration pushed ahead with tariffs on imports from its key trading partners. German bunds led a drop in most core European bonds, though Italy’s gained along with those of peripheral European nations. Spanish assets rallied after Prime Minister Mariano Rajoy was ousted by opposition parties, opening the way for Socialist leader Pedro Sanchez to take over. The euro edged lower.

Investors remain optimistic that threats of more international tariffs will not materialize into an all-out trade war between the U.S. and its key partners, while the latest developments in Italy and Spain also removed uncertainty, providing some well-needed relief within Europe. Friday’s U.S. jobs report may show payrolls rising and the unemployment rate holding at the lowest since 2000, bolstering confidence in the Federal Reserve’s policy-tightening path.

West Texas Intermediate crude declined as rising U.S. output overshadowed a surprise drop in stockpiles, with traders also focused on whether Saudi Arabia and Russia will boost production.